India Tops Expat Remittances

Remittances to India driven by white-collar expats are witnessing an unprecedented surge, suggesting that a new trend is in the making. EPISODE #157

Dear Reader,

A very Happy X’Mas Monday to you. In fact, the last Monday of 2023. With this we begin preparing for what is presumably another equally dramatic year.

While on the subject, I would like to inform you that I am on a break till 2 January. The next newsletter will be in your inbox on 8 January. Till then stay safe and wish you a very Happy New Year.

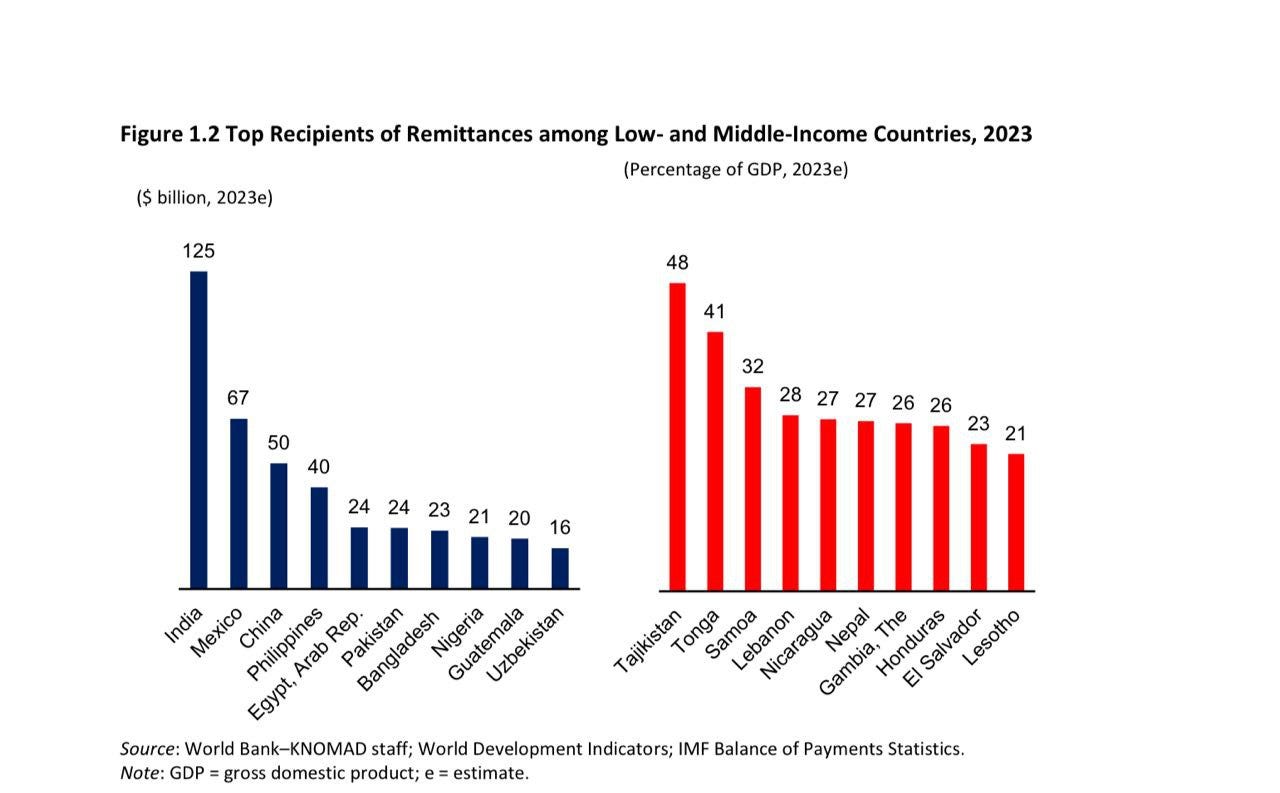

Meanwhile, new data released by the World Bank last week on international remittances was revealing. According to it, India beat previous forecasts by $14 billion and is projected to reach $125 billion in 2023.

The growth in remittances is rather dramatic considering that two years ago it aggregated $89.38 billion. What are the reasons? Is it the start of a new trend? I will attempt to answer all these questions in this week’s newsletter.

The cover picture is sourced from Pexels and taken by Olia Danilevich.

A big shoutout to Surendra, Gautam and Premasundaran for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all you readers. Gratitude also to all those who responded on Twitter and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I would be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

Record Remittances

Last week the World Bank released its annual tracker on global remittances for 2023. It showed that globally remittances at $669 billion grew higher than forecast.

The Bank attributed this to the improving job markets for the countries of the Organisation for Economic Cooperation and Development (OECD) and the Gulf Cooperation Council (GCC)—which have been buoyed by surplus oil profits over the last two years.

India, like always, was the top recipient with $125 billon—accounting for little under fifth of the global remittances in 2023.

There is an important subtext to this growth though. It seems to be accelerating in the last three years.

A New Growth Trajectory?

The graph above makes it clear that the trend line has a distinct uptick beginning 2022—growing by 24.4%.

Thereafter this trajectory is sustained, especially if we take into account the forecast put out by the World Bank for 2024: Remittances to India are projected to grow to $135 billion—which is over 50% of what accrued in 2021.

And, this when the Bank is forecasting a slowdown in remittances next year.

“Remittances’ growth in South Asia is once again projected to be the highest among LMICs in 2024, even though it is projected to moderate to about 5% in 2024 from 7.2% in 2023.

The overall projection for remittance flows is likely to be driven by three factors that represent a combination of host-economy and country-specific conditions: a slackening of growth and labor market conditions in South Asian migrants’ high-income host economies; uncertainty related to ongoing global conflicts as well as climate change, which may exacerbate the labour market difficulties of South Asian migrants in all host economies; and migrants’ preference for informal over formal channels of money transfer to countries embroiled in economic crises.”

It is remarkable therefore to see remittances growing despite inclement circumstances. The obvious question is why is this happening.

There are some clues in the World Bank report.

Non-resident Deposits

Again, non-resident deposits is another mode of mobilisation of remittances that India tops.

According to the World Bank as on September this year, the stock of NRI deposits was estimated at $143.07 billion—an increase of $10 billion from last year. The closest country was Sri Lanka with an estimated $7.78 billion.

And, like in the case of overall remittances, there is a clear uptick in accruals of NRI deposits in recent years.

In the case of NRI deposits the point of inflection seems to be 2014.

White-Collar Expats

Another reason, the World Bank report notes, is the structural shift of Indian expats away from largely low-skilled, informal employment in destinations like the Gulf Cooperation Council (GCC) countries to high-skilled jobs in high-income countries such as the United States, the United Kingdom, and East Asia (Singapore, Japan, Australia, New Zealand).

This is corroborated by the Fifth Round of the Survey on Remittances, 2020–21, conducted by the Reserve Bank of India (RBI).

The RBI found that between 2016–17 and 2020–21 (see graphic above), the share of remittances from the United States, United Kingdom, and Singapore increased from 26% to over 36%, while the share from the five GCC countries (Saudi Arabia, United Arab Emirates (UAE), Kuwait, Oman, and Qatar) dropped from 54% to 28%.

As the World Bank report points out, with a share of 23% of total remittances, the United States surpassed the UAE as the top source country in 2020–21. About 20% of India’s emigrants are in the United States and the United Kingdom.

Further, the Indian diaspora in the United States is highly skilled. In 2019, 43% of Indian-born residents of the United States had a graduate degree, compared to only 13% of US-born residents.

Inevitably, higher education maps to high income levels with direct implications for remittance flows, the report added.

In 2019, the median household income for Indians in the United States was nearly $120,000 compared to about $70,000 for all Americans!

The Digital Push

Another contributory factor is the home grown Unified Payments Interface (UPI)—the inter-operable payments platform which revolutionised the business of payments powered by the National Payments Corporation of India (NPCI). Today India is averaging 10 billion transactions a month.

Beginning last year, UPI has begun to expand its global footprint.

I wrote about this earlier this year so will not dwell upon it. Sharing the link below in case you wish to brush up on the mechanics of a globalised UPI.

GLOBALISING UPI

Dear Reader, A very Happy Monday to you Little under a fortnight ago India and Singapore enabled a real time payment linkage, wherein residents of both countries could undertake cross-border transactions using their mobile phones. Overnight, the international footprint of the Unified Payments Interface (UPI), the real time payment mechanism from the stabl…

The UPI footprint now extends to Singapore and the UAE—two key sources of remittances.

What this has done is to reduce costs of money transfers. The combination of growth in white-collar expats combined with the reduction in cost and time in money transfers to India are creating a network effect.

Taking note of this the Bank says:

“Remittance flows to India were also boosted by higher flows from the GCC, especially the UAE, which accounts for 18% of India’s total remittances and is the second-largest source after the United States.

Remittance flows to India benefited particularly from its February 2023 agreement with the UAE for establishing a framework to promote the use of local currencies for cross-border transactions and cooperation for interlinking payment and messaging systems.

The use of dirhams and rupees in cross-border transactions would be instrumental in channeling more remittances through formal channels.”

Further, a related analysis by the World Bank shows that digital services lower the cost of transfers when compared to cash repatriations.

From the graphic above it is clear that digital costs of transfers are lower. And in this, the digital costs in South Asia are the lowest.

In the final analysis it is clear that remittances to India have turned a corner. With India growing in stature at the global high table, Indian expats can look to harvest the gains in social capital. In turn, this would mean more remittances to India—improving the country’s outlook on the external sector.

A clear win-win situation.

Recommended Viewing/Reading

Sharing the latest post of Capital Calculus on StratNews Global.

The worst kept secret about Indian agriculture is Madhya Pradesh. The state has witnessed a dramatic turnaround, particularly in the last five years, to emerge as the food bowl of India. But few of us know about it.

This economic fact came into public scrutiny when Ashok Gulati, India’s finest voice on agriculture, drew a connect between the outstanding electoral success of the Bharatiya Janata Party—which overcame a four-term anti-incumbency to win a massive majority in the just concluded elections to the state assembly—and the gains accruing from the transformation of the states’s agrarian economy.

I spoke to Ashok Gulati to explore this further. In a very revealing conversation he walked me through the changes that enabled this dramatic makeover—a lesson to other agrarian states in the country.

Do watch and share your thoughts.

Till we meet again next week, stay safe.

Dear Anil,

Interesting article! Very relevant also , since around 20% of India s total foreign exchange reserves are derived from remittances.Remittances largely lead to increase in cash flow, hence result in an increased purchasing power among the population. At micro level,it boosts the family income,leads to better nutrition, higher spending on education and in general a better standard of living.

From a macro perspective, it helps in pushing up the GDP growth. Remittances are also very useful when a country faces macro economic shocks, natural disasters, like floods, earthquake etc, political upheaval, financial crisis etc.

Today's HT has an article on how since July 2023, India and UAE agreed to settle trade in rupees instead of Dollars.Some of the Russian oil imports too have been settled in rupees.To boost the rupee, s role in cross border payments, RBI has allowed many banks to settle trade in rupees with 18 countries since last year .

This is an outcome of available educational institutions in India and the talent, hardwork, dependability and determination of the NRI population who went abroad and earned a reputation for being reliable employees; that resulted in many NRI Heads of top notch companies, especially in the IT and related sectors. The further increase of the IIT and IIM institutions, along with other institutions for higher education has been justified as not only do they fulfill our domestic requirements but also are a profitable investment in the light of the figures mentioned in your article Anil. A morale boosting write up, very well presented. 👌