Geoeconomic Fragmentation

The ongoing decoupling with China and the new era of regional wars is risking global gains and another economic crisis. EPISODE #148

Dear Reader,

A very Happy Monday to you.

Little over a week ago, Marrakech, Morocco hosted the annual meetings of the International Monetary Fund (IMF). The meetings attended by the finance ministers and central bankers of the world is the Jackson Hole equivalent for official deliberations on the global economy.

The global economy as I pointed out last week is very precariously poised, especially after geopolitical risks spiked in the aftermath of the deadly Hamas attack on Israel.

One big takeaway from the meetings in Marrakech was the note of caution on geoeconomic fragmentation that has gained momentum in the aftermath of the strategic uncoupling initiated with China.

This week I put the spotlight on this phenomenon. Essentially a sequel to last week’s newsletter: The New Era of Wars.

The cover picture is of the annual Fund-Bank meetings in Marrakech, Morocco and sourced from the IMF.

A big shoutout to Surendra, Premasundaran, Shashwathi, Balesh, Gautam, Ranjini and Vandana for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all you readers. Gratitude also to all those who responded on Twitter and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I would be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

The Decoupling

Little over a week ago, Marrakech, Morocco hosted the annual meetings of the International Monetary Fund (IMF).

It is, like I explained in the introduction, the global high table for official economic honchos. The inclement backdrop of the global economy only made this summit that much more important.

Worryingly, the IMF issued a veiled warning on the world economy. Keep in mind that their assessment does not extend to the geopolitical risks triggered by the deadly Hamas attack on Israel—which happened just before the annual meetings.

“The global economy continues to recover from the pandemic, Russia’s invasion of Ukraine and the cost-of-living crisis. In retrospect, the resilience has been remarkable.

Despite war-disrupted energy and food markets and unprecedented monetary tightening to combat decades-high inflation, economic activity has slowed but not stalled.

Even so, growth remains slow and uneven, with widening divergences.

The global economy is limping along, not sprinting.”

The IMF projects that world economic growth will slow from 3.5% in 2022 to 3% this year and 2.9%. next year.

“This remains well below the historical average.”

There is some good news from the IMF prognosis though.

The annual rate of inflation which caused a serious cost of living crisis across the world, continues to decelerate. It dropped from 9.2% in 2022, to 5.9% this year and is forecast to be lower at 4.8% in 2024.

“Core inflation, which excludes food and energy prices, is also projected to decline, albeit more gradually, to 4.5% next year.

Most countries aren’t likely to return inflation to target until 2025.”

While the macroeconomic conditions are stabilising, the IMF pointed to the consequences of new geopolitical risks—especially the ongoing decoupling between China and the West. This has only worsened after a new front was opened in regional wars following the face off between Hamas and Israel.

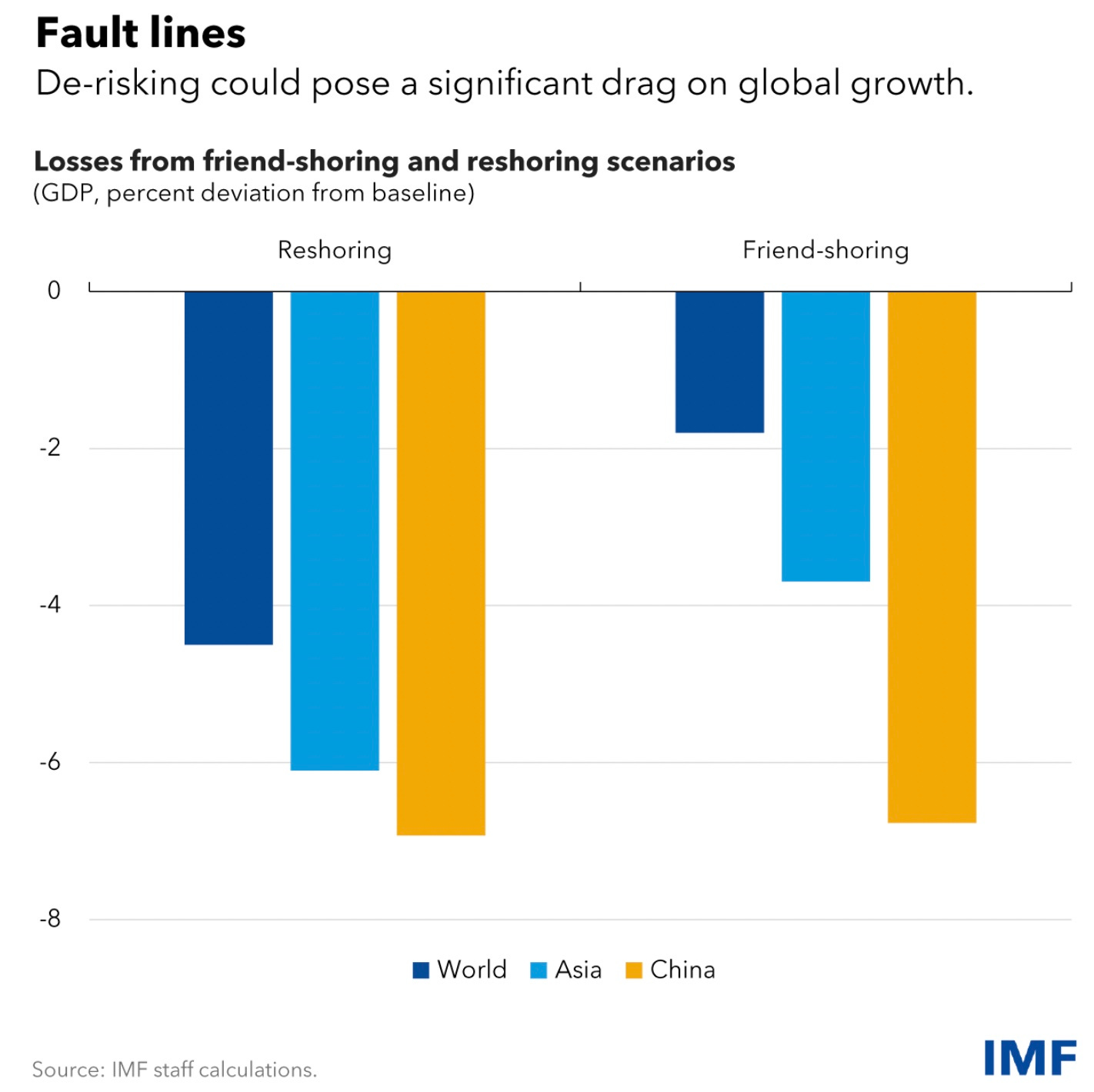

“De-risking strategies by China and the United States and other OECD countries that aim to reshore production domestically or friend-shore away from one another can result in a significant drag on growth around the world even assuming no new trade restrictions with third countries—especially in Asia.”

The odds of this outcome worsened with the deadly attack by Hamas on Israel. Not only has it worsened geopolitical risks, it has plunged a region that had survived the recent global shocks into chaos.

Worse, the likely strategic choices will only accelerate the trend of “reshoring” and “friendshoring”.

In short the world is steadily reversing the gains from globalisation, which despite its shortcomings, lifted many countries.

Geoeconomic Fragmentation

The meetings in Marrakech flagged the threat of growing divide in the world. The worsening fault lines are casting a shadow over global growth in general and that of China in particular.

The above graphic put out by the IMF is revealing. Everyone loses out due to geoeconomic fragmentation.

But China’s loss is the largest. Not surprising given that their growth model has relied on servicing global demand and positioning themselves as the factory of the world. Given the dubious nature of their statistical systems, the loss of growth could be much greater than what the IMF—which only relies on official data—is projecting.

And by extension it can be safely argued that global economic growth too will suffer as a consequence.

As the IMF puts it:

“Similar to economic integration, the impact of geoeconomic fragmentation can be felt via changing patterns of trade, technology, labor, capital, and the provision of global public goods. These channels interact within and across national borders as well as geographic blocs.

They can operate with greater force during periods of uncertainty, both in terms of the uncertain transition to a more fragmented world, as well as due to lack of clarity about the final shape that a more fragmented world might take.”

The Way Forward

Ideally the world should not be where it is. Unfortunately reality is never what we wish it to be.

Consequently, we have to acknowledge the emergence of a multipolar world with the presence of a few dominant players. While United States will continue to be the single most influential presence, there are others like China who will seek to challenge them—either individually or as the axis of the like minded.

The existing multilateral framework, evolved in the aftermath of the second World War, has outlived its utility. It is highly inadequate in a multipolar world.

Worse, these institutions have been subjected to intellectual capture with deadly consequences—as was evident in the case of the World Health Organisation (WHO), which dangerously erred in glossing over the origins and spread of the covid-19 pandemic in China.

Similarly, the World Trade Organisation has been rendered ineffective in the aftermath of the slug fest between the global majors. The outcome has been either bilateral free trade agreements or the creation of conclaves of the like minded or allied countries.

All of this shrinks the opportunities for less developed economies as well as emerging markets. As the IMF points out:

“Reduced trade-led income convergence across countries will have significant welfare costs for low-income countries (LICs), while in AEs (advanced economies) low-income consumers would be disproportionately hurt by higher prices. Mitigating policies may reduce some effects felt by specific populations but the aggregate effect is to lower living standards.

A shift to near- or “friend”-shoring could reduce local producers’ vulnerability to geopolitical developments and global shocks (for example, pandemics) but would also involve sizeable costs and significant disruptions as markets became increasingly segmented across national borders.”

An obvious corollary of this is a spike in the trust deficit among countries. In turn this only makes a bad situation worse.

It is clear then that the world in general and its economy is in a bad place. There is a leadership vacuum that needs to be filled. In a multipolar world this can no longer be achieved by a single country.

The good news is that the emergence of the G20 forum is providing a viable alternative. India’s message, an extension of where Indonesia left off during its term as a leader of the forum, of Vasudhaiva Kutumbakam (Sanskrit for "The World Is One Family") at the just concluded Delhi summit of G20, is a good rallying cry.

Given the inclement circumstances the world will need much more than just a great rallying slogan. Fingers crossed.

Recommended Viewing/Reading

Sharing the latest post of Capital Calculus on StratNews Global.

Last month, Parliament, gave its near unanimous approval on a new law reserving a third of the seats in legislatures for women. A far cry from when it was first introduced in 1996. Stiff opposition from some regional parties nixed that proposal and other efforts thereafter. Exactly why it took 27 years for Parliament to generate the desired consensus.

This historic move holds major ramifications for India’s rapidly transforming socio-economic framework. Especially, since in the last decade and more, the cohort of women have emerged as a powerful political constituency and have been the focus of public policy seeking to universalise banking, toilets, cooking gas, housing, drinking water and so on.

To unpack these implications we spoke to Shamika Ravi, economist and a member of the PM’s Economic Advisory Council. The conversation is unmissable, especially for the striking insights and perspectives that Shamika shared.

Sharing the link below. Do share your thoughts.

Till we meet again next week, stay safe.

Dear Anil,

Informative article and very accurate analysis of the present world scenerio! China is facing deflation and rising youth unemployment.The main reasons could be the harsh curbs under the zero- COVID policy, it's economic model based on debt fuelled investment and the focus on export oriented growth.

The Israel - Gaza war has made the global economy vulnerable. Major global economic issues are inflation due to rising energy price s and supply chain distributions. As you rightly say , G-20 can serve a crucial platform for global economic discussions addressing major issues including trade.G-20 accounts for 75% of international trade and around 80% of Global World Product ( GWP). India s presidency focused on protecting the vulnerable , promoting equitable growth and enhancing macroeconomic financial stability. India strives for a collaborative and inclusive future on the global stage.

I would rather focus on what is it there for India in this De-risk China scenario! We have an excellent opportunity now to catch up and be part of the global manufacturing chain. This will also bring us closer to USA in geostrategic sense to deter China from troubling us. USA also needs Quad to deter Chinese misadventures in Indo Pacific. Let us not worry about IMF, global growth but focus on our growth and the policies that Modi Govt have to make best of the opportunities now. Of course, Modi is doing all that he can but from the states, we need concerted actions for rapid economic development.