A New Era of Wars

The attack by Hamas on Israel is another reminder of growing geopolitical risks that are worsening the odds for the global economy. EPISODE #147

Dear Reader,

A very Happy Monday to you.

Two weekends ago, Hamas, the militant organisation governing the Gaza strip of the Palestinian territories, launched a brutal attack on Israel. It plunged the region, which has been gingerly working out the historic wrinkles in the relationship among countries, into turmoil and put the world economy on fresh notice.

This deadly face off between the Hamas and Israel, which happened in the backdrop of the ongoing Russia-Ukraine war and simmering tensions between China and Taiwan, has ratcheted up geopolitical risks—jolting afresh an already battered global economy and accelerating geoeconomic fragmentation.

This week I put the spotlight on growing geopolitical risks and attendant implications. Do read and share your feedback.

A big shoutout to Surendra, Premasundaran, Vandana, Aashish, Ranjini, Gautam, VK and Balesh for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all you readers. Gratitude also to all those who responded on Twitter and Linkedin.

The cover picture is taken by Cole Keister and sourced from Unsplash.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I would be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

Israel’s 26/11

Two weekends ago, Hamas, the militant organisation governing the Gaza strip of the Palestinian territories, launched a deadly attack on Israel leading to the death of an estimated 1,300 people, including children. In the retaliation following this audacious attack on Israel, an equal number of people are estimated to have died in the Palestinian territories.

The attack was akin to what India suffered when terrorists trained by Pakistan crossed the border by sea and unleashed mayhem in Mumbai on 26/11. Due to a combination of rear guard action by police, army personnel and a bit of luck, India managed to mitigate the damage. Otherwise the terrorists were operating with identical intent.

Undoubtedly, this bloody face off between Hamas and Israel has plunged the entire Middle East into chaos. Sadly, this setback comes at a time when the region was gingerly working towards resolving the historic wrinkles in their relationships. In fact, Saudi Arabia was in the last mile of a deal recognizing Israel.

And, the blow up occurred just weeks after an agreement—inked on the sidelines of the summit meeting of the G20 in New Delhi last month—to launch an economic corridor connecting India to Europe through several countries, including the United Arab Emirates (UAE), Saudi Arabia, Jordan and Israel.

The latest eruption in regional violence comes in the backdrop of an ongoing war between Russia and Ukraine and growing fears of a Chinese assault on Taiwan. Together with the simmering tensions between the United States and China, this has caused an unprecedented spike in geopolitical risks.

In turn this is casting a long shadow over an already battered global economy, which was barely recovering from the back-to-back challenges posed by the once in a century covid-19 pandemic, Russia-Ukraine conflict that unleashed inflation, and macroeconomic disruption forced upon the entire world after the US Fed raised interest rates in rapid succession. Sadly, they have fed off each other.

These concerns become more acute when we take into account the growing number of actor-less threats. While the covid-19 pandemic was neither the first nor the last, a rapidly growing concern is climate change and the extreme weather conditions it has induced across the world, including India.

In short geopolitical risks are touching a new high. And, this has implications for the world in general and the global economy in particular.

A New Era

Two surveys, a year apart, flag the rapidly deteriorating circumstances.

The results of the survey—Future Risks Report co-published by AXA and IPSOS—conducted in 2022 reveal how “geopolitical instability”, in the aftermath of the Ukraine-Russia conflict, jumped to the second spot in the list of top-10 threats facing the world.

In fact, growing geopolitical instability, especially after the Russia-Ukraine conflict, has moved up two related threats, cybersecurity and energy risks, in the rankings. The latter in fact was never in the top-10 threats in the last five years.

The survey’s introduction argued:

“The 2022 edition shows a fragmented, overheated world in which crises are increasingly occurring all at the same time, rather than one succeeding another.

In addition to the major risks already discussed in previous years—such as pandemics, cyber risk and climate change—this year we are seeing more threats linked to geopolitics, energy, and economic and social instability.”

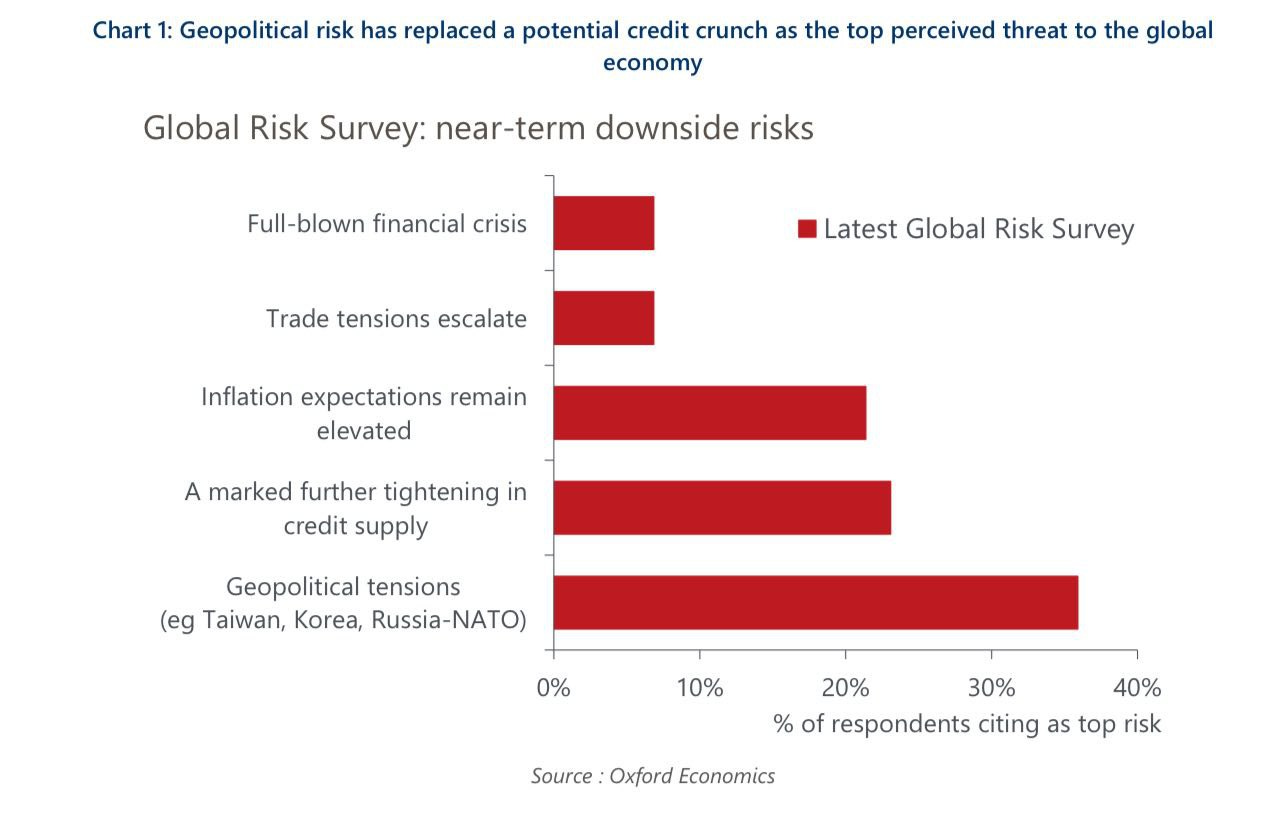

The second survey (above graph) conducted by Oxford Economics in July this year confirms the fears voiced in last year’s polling of global sentiments by AXA-IPSOS:

“Our latest survey confirms that businesses’ perceptions of risks to the global economy have shifted.

Geopolitical tensions are now the main focus of concern, both in the near term and the medium term.”

Worryingly the risk perception over geopolitical tensions have worsened from the last survey conducted in April this year by Oxford Economics. At that time about one in five of global businesses were worried about geopolitical risks. This proportion has grown to two out of five in the latest survey.

And this is not just a short-term concern. Three out of five respondents viewed geopolitical risks as a very significant risk to the global economy over the next five years.

The Fallout

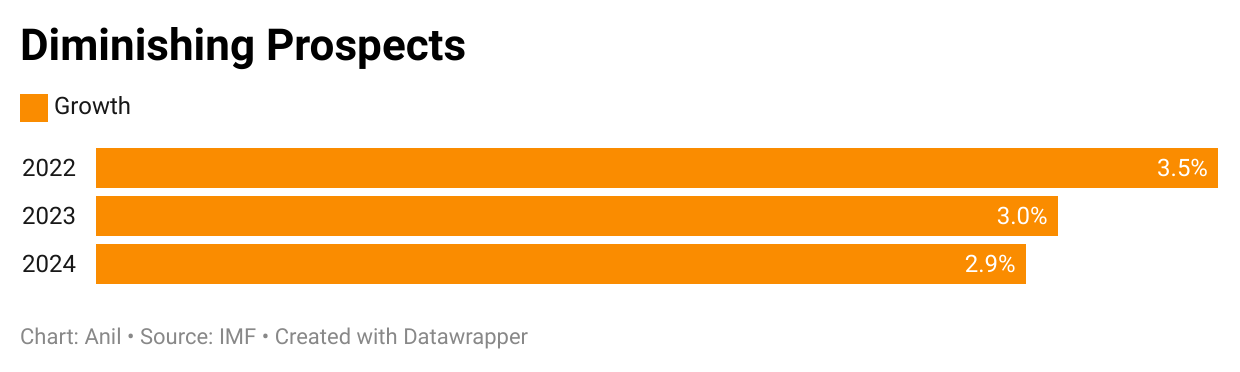

Macroeconomic data shows that growing and a changing risk profile is exacting a price: global growth.

In its latest World Economic Outlook, released last week, the International Monetary Fund, projects a deceleration in global growth from 3.5% in 2022—the post-covid year—to 2.9% next year.

Frankly, given the magnitude of challenges facing the world, the IMF, in my viuew, has erred on the side of optimism.

Preferring to view the situation as a cup half-full—hopefully, their optimism bears out—the IMF noted:

“The global economy continues to recover from the pandemic, Russia’s invasion of Ukraine and the cost-of-living crisis.

In retrospect, the resilience has been remarkable. Despite war-disrupted energy and food markets and unprecedented monetary tightening to combat decades-high inflation, economic activity has slowed but not stalled. Even so, growth remains slow and uneven, with widening divergences.”

The last line of the above quote (in bold) is significant. The aggregate number hides the worrying regional variations and cost of growing geopolitical risks—and consequent geoeconomic fragmentation.

Even in aggregate terms the opportunity cost is staggering as the supply of global public goods like trade, investment, and technology transfer start to shrink.

As concepts like friendshoring take root, the trade links established over the last four decades start to unravel—and as always the brunt of this will be borne by countries at the bottom of the pyramid.

Similarly this will reduce capital flows and foreign direct investments to these countries. This in turn will deny resources to these nations. Especially low-income countries and emerging markets, desperately in need of funds and technology to drive domestic investments.

According to an IMF study, the cost of unchecked geoeconomic fragmentation could be as high as 7% for the global economy and shave off as much as 12% of gross domestic product for some countries. Close to the price the world paid for shutting down the global economy as a line of defence against the spread of the covid virus.

Arguing that deeper fragmentation will exact greater costs, the IMF said:

“Depending on modelling assumptions, the cost to global output from trade fragmentation could range from 0.2 percent (in a limited fragmentation / low-cost adjustment scenario) to up to 7 percent of GDP (in a severe fragmentation / high-cost adjustment scenario); with the addition of technological decoupling, the loss in output could reach 8 to 12 percent in some countries.”

Clearly, the wages of war are exacting a price.

The big question is why is the world willing to pay this price at a time when its battle with climate change is poised to cross the tipping point?

Recommended Viewing/Reading

Sharing the latest post of Capital Calculus on StratNews Global.

A few weeks ago, the Nifty-50 scaled the peak of 20,000 for the first time ever. To be sure since then the index has dropped below this level. While the record was impressive, more significant is the underlying message of the index which has evolved as the bellwether of the Indian economy.

Not surprisingly then, the Nifty-50 is the benchmark index used by investors, domestic as well as foreign. The index which includes a very diversified set of 50 stocks, reflects the rapidly evolving New India story.

To unpack the implications we spoke to the very insightful and brilliant Srinivas Jain, Executive Director, and Head of Strategy, SBI Mutual Fund.

Sharing the link below. Do share your thoughts.

Till we meet again next week, stay safe.

Dear Anil,

Very interesting and informative article.you have analysed the current situation so well and covered all aspects of the impact of the unfortunate war situation!!

Dear Anil

Israelis and the whole world was shocked to see the brutality of the mindless attack launched by the Hamas. There was simply no justification for slaughtering so many innocent people including children. Naturally Israel was bound to retaliate. Now it needs to be seen how many other countries take sides and jump into the fray.

What happened was inhuman and unpardonable. The aftermath is going to be devastating as well. No doubt, the geopolitical risks have heightened. No country knows for sure what the next upheaval is going to be. One imagined that Covid was one of the worst experiences in a lifetime but there never seems to be an end to our miseries. We are literally rolling from one upheaval to another. The world economy is bound to feel the impact. You have mentioned concerns regarding climate change but honestly no one seems to care. We seem to be living in a world where human lives have no value. Who cares about the earth?