THE UPI MOMENT FOR PERSONAL DATA

The launch of the Account Aggregator framework has set the stage for frictionless monetisation of an individual's data using Fintech. EPISODE #39

Dear Reader,

A very Happy Monday to you.

Last week India launched yet another ambitious plan to fundamentally alter status quo. This time in the business of individual data.

The Account Aggregator (AA) framework, enabling this play, was launched at a virtual event hosted by iSPIRIT, a terrific outfit of tech evangelicals based out of Bengaluru who helped create the India Stack architecture powering UPI or the Unified Payments Interface. The eight authorised entities are under the regulatory purview of RBI.

The AA enables consent-based monetisation of data, particularly of individuals and small enterprises, which was otherwise invisible to most financial intermediaries. Once Parliament signs off on the pending data privacy law, all the parts of this strategy will be in place. This exchange of verified individual data will not only spur financial inclusion and the ongoing Fintech revolution in India but it is also likely to stoke a fresh boom in consumption—something India so desperately needs in a post-covid world.

Legacy media underplayed the event and hence the import of this effort may have escaped your attention. Accordingly this week I explore the AA framework and its potential.

My last week’s piece on asset monetisation drew terrific response and some basic queries—my apologies for not being clear enough—especially in the backdrop of an ongoing serious disinformation campaign. Just to explain the asset monetisation example in very simple terms: see it as a house you own remaining idle as you are located in another city; if you rent it out to fund its upkeep and maybe earn a bit extra then you are monetising your asset—earning rental incomes without handing over the asset. Now when the private sector does it—as in the case of Oyo or AirBnb—we laud it. The obverse analogy with respect to the government is obvious. I rest my case.

The cover picture this week is from a time pass moment at a red light in Delhi. I just got lucky with the final outcome. Enjoy.

A big shoutout to Abhijit, Shreekant, Gautam, Vandana, Premasundaran, Vivek, Rakesh, Balesh, Yugainder, Aashish and Mohan for your informed responses, appreciation and amplification. Gratitude also to all those who responded on Twitter and LinkedIn. It is key to growing this newsletter community. And, many thanks to readers who hit the like button 😊.

If you are not already a subscriber, please do sign up and spread the word.

DATA DEMOCRACY

Last week we witnessed the soft launch of the Account Aggregator (AA) framework. Eight banks, including State Bank of India, IDFC Bank and ICICI, formally began offering these services. A two-hour virtual event hosted by iSPIRIT, the brilliant set of tech evangelicals who created the India Stack architecture used by the UPI payments system, drew up the likely scenarios, including data empowerment.

By this I mean that all the data—whether it be wealth or health statistics—of an individual can now be captured in a digital environment and shared using an AA. But before we go all paranoid, this transaction will be consent-based and the AA is data-blind—neither can they view the data passing through them nor can they store it. And companies who wish to use this data for commercial use will have to pay for it—the tariff for which will vary, depending on whether it is being used once or multiple times. Hitherto this value was either unknown or the data was being harvested for free by various platforms.

Something that Nandan Nilekani, the former head of the Unique Identification Authority of India (UIDAI), chairman of Infosys and a key backer of AA, often sums up so succinctly: Indians are economically poor but data-rich. The launch of AA is seeking a convergence of these two extremes through data empowerment.

Exactly why I believe this is another “Freedom at Midnight” moment. And what a coincidence for this to happen in the 75th year of Independent India. Indeed, it is another tryst with destiny.

The UPI Moment

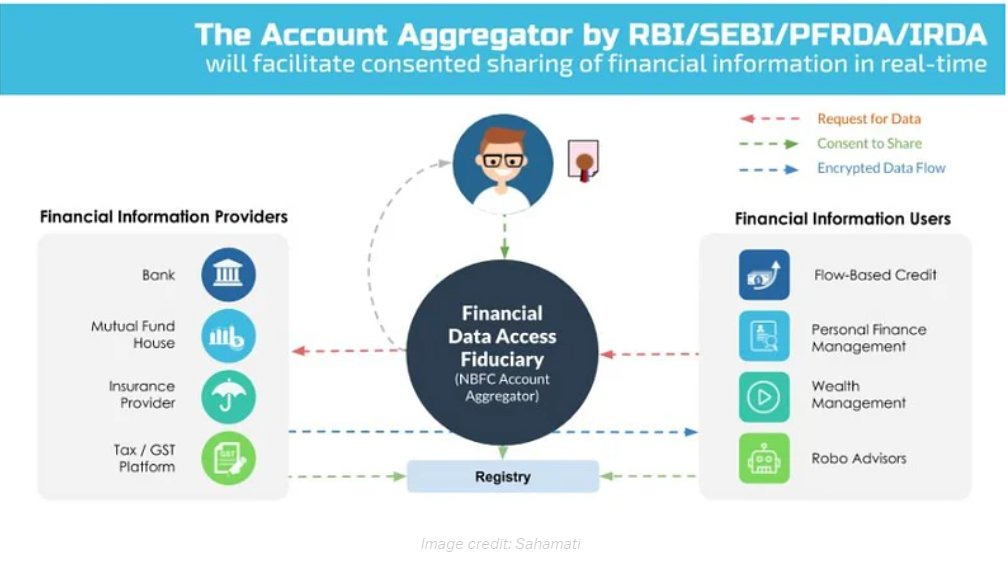

For the uninitiated the AA is very similar to a financial intermediary. However there is a big difference. In this instance the AA oversee the exchange of an individual’s data instead of facilitating money transfers. Their institutional presence protects the privacy of an individual’s data and also mitigates against misuse by companies. The graphic below from Sahamati captures this well.

Typically this data—capturing cash flows in an individual’s bank account for instance—can be mined to offer non-collateral based loans. A great example would be how the over 100 million beneficiaries of the nearly Rs1 trillion rural employment guarantee scheme can use their data capturing receipts from the government to avail of loans. At the moment this is not possible since borrowing is presaged on collaterals and this data is not shared.

In our middle class lives it can mean an earlier start. Have mentioned this example earlier, but no harm in repeating it. Somewhere in the mid 1980s when I started working one had the opportunity to join an upcoming housing society in what was then an outpost of Delhi: Mayur Vihar. The only catch was to manage the upfront payment within the confines of a three-figure monthly salary. A bank loan was the obvious option. I approached several public sector banks and was turned away as I had no collateral to offer. They said, at best I could avail of a short-term personal loan at a usurious rate. Long story short I gave up on my dream.

Fast forward to 2021, I could, in a similar circumstance, get the same loan in a jiffy. The lending agency would be pouring over my financials, including my bank statement. They would be looking at cash flows and my credit history to see whether I am loan worthy or not. And not bother about providing a collateral—an outdated concept that is called ‘lazy banking’ today.

In fact this pivot to cash-flow based funding is what is powering the Buy Now Pay Later (BNPL) boom for consumer goods. Several FinTechs are now looking to employ the same principle for all kinds of lending—including to the conventionally disenfranchised lot of small enterprises. The AA framework will only nudge this further.

You may recall that I had previously written about this trend. Sharing some relevant passages:

“Take Mumbai-based Indium Finance which is targeting MSMEs to extend collateral free business loans and flexi working capital to fund seasonal business requirements. You can get the drift. By being credit-enabled MSME units are being partially de-risked, making them attractive for commercial loans. This kind of credit empowerment can only translate into more business activity for them.

This model of embedded lending is now about to get scale with the imminent launch of OCEN or Open Credit Enablement Network. The idea is here is similar. Tap the data generated by business (like cash flow, GST receipts) and monetise them. Exactly why they say data is the new oil.

To sum up then, the growing digital footprint of India is creating a credit history in its wake. Now thanks to big data, this can be mined to provide create financial muscle in MSMEs (the same template can be extended to individuals too).”

In case you wish to re-read the column please click here.

Since the architecture of AA uses Aadhaar as the foundation it is similar to the technology stack that powered UPI. There is therefore every reason to believe that the AA framework is likely to see a similar trajectory of growth. This is because the enabling power provided by tech is converging with the growing aspirations of an average consumer. The combination is potentially explosive.

According to RBI, the volume of transactions using UPI aggregated 189.3 million in May 2018 and 733.4 million in the same month in 2019. Thereafter the growth has been exponential, surging to 1.23 trillion in May 2020. In May of this year the volume of UPI transactions more than doubled and is estimated at a staggering 2.54 trillion.

AA is powering the audacious idea of taking credit to the borrower, exactly the obverse of what we are used to today. Two years ago I had to take leave from my work place for a day to close the paper work on a car loan availed from a PSU bank. An AA framework will ensure closure in real time.

Check out the tweet from a FinTech CTO below.

Clearly the AA framework has put India on the threshold of a data revolution. To realise this potential though it is imperative that Parliament enact the privacy law pending before it since 2019. Yes the AA is structured in a manner that it protects the privacy of an individual’s data when it is monetised. But the loop has to be closed by providing protection under a privacy law, especially in an era where cyber crime will be the new normal.

Recommended Reading

Last week I published my latest monthly column for the Economic Times.

This time I focused on what I call ‘India’s Minto Bridge Problem’. It is a metaphor for all that is wrong with public policy. Something that has been the bane of projects creating public goods, especially in infrastructure. Frequent cost overruns, often by errors of commission, means we get trapped in a cycle of expending more good money after bad money.

Sharing a partial screenshot of the piece below:

If you are interested in reading the piece please click here.

Coincidentally, over the weekend, I stumbled upon an opinion piece written by Viraj Tyagi, CEO of eGov Foundation, published in the Hindu. It makes the same point and argues that a turnaround is in the making with improved delivery of some public services.

Sharing some key passages from it (the highlighting is mine):

“In our experience in working in the area of service delivery by urban local bodies, we find that citizens’ default position is low trust. Their past experiences, where requests have not been responded to or have vanished into the ether, adds to this sense of apprehension. Corruption makes this worse. The worst is paying a bribe and still not being served. We also observe a power imbalance: citizens feel that they do not have any recourse.

These frictional interactions pile up over time. They lead to apathy, disengagement, a ‘nothing will happen’ mindset.

The good news is that when government service delivery manifests this new currency of social trust — visibility of status, alerts at key stages, knowing who is accountable, ways to escalate the complaint, ways to rate or give feedback — the confidence of citizens starts to grow. Over time, the trust deficit is reversed, and citizen participation increases.”

If you are interested in reading the entire column please click here.

Till we meet again next week. Stay safe.

Dear Anil,

very informative article on AA and data empowerment.In fact, it will decrease the repetitive administrative responsibilities and the employees will have more time ti focus on creative and rewarding job related activities. I think last year NITI AAYOG Also made a policy on data empowerment and protection.

We live in a data driven world. While on one hand , there is a move towards data based governance and decision making, on the other hand there is a concern about the "statistical vaccum "due to a number of national statistical bases getting eroded either through delays or data suppression.. There is a need for decentralized system of data collection process and states should build their own data bases. The states need to invest heavily in in both human and technical infrastructure with a built in quality control measure.

Really exciting development Anil and these days I am keeping abreast of these very important developments, by catching up on your weekly newsletter. Thank you. Everything seems to be the perfect recipe for a dynamic GDP growth; just what the doctor ordered. I only wanted to know whether this easy availability of funds will also be a catalyst for a larger number of defaults in repayment of loans ?