THE INDIAN STARTUP MOMENT

Domestic Startups have come of age and are rapidly claiming front and centre in the Indian economy, says a new analyst report. EPISODE #120

Dear Reader,

A very Happy Monday to you.

Last week I interviewed Sajith Pai, a seed investor, at the Indian Tech Fund Bloom Ventures, for StratNews Global. Sajith is the co-author of the Indus Valley Report—often described as the holy grail of the Indian startup ecosystem. The conversation, included at the end of this week’s newsletter, took up from the 2023 edition of the Indus Valley Report released a few weeks ago.

The interview with Sajith explored the fascinating insights and trends captured in the report. The biggest takeaway is that this is the coming out moment for Indian startups—mirroring the transformation of the Indian economy—and how they are rewiring the Indian economy.

Even pop culture is capturing this makeover Check out Shark Tank, the reality television show from Sony India which showcases upcoming startups across the country. And, let us not forget that startups were the biggest spenders in the last edition of the Indian Premier League for cricket.

So this week I explore the Indian Startup phenomenon through the lens of the Indus Valley Report. I would recommend that you read the newsletter and also watch Sajith’s interview to get a complete picture.

This week’s cover picture is a lovely street view of a melon vendor’s wares. It is taken by Narayani Gurunathan. Thank you Narayani.

A big shoutout to Shiv, Laxmi, Abjijit, Premasundaran, Surya, Balasurya, Vandana, Ranjini, Gautam and Niranjan, for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all you readers. Gratitude also to all those who responded on Twitter and Linkedin. Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

INDIA UNPACKED

Anecdotally, especially given our personal experiences with frictionless payments using the Unified Payments Interface (UPI), e-commerce transactions and accessing utilities online, we are aware that India is transforming. These examples have constantly resonated in this newsletter over the last two years.

Now, the latest Indus Valley Report (2023) from Blume Ventures has pulled all these trends together to etch a compelling, comprehensive narrative about ‘New India’. In a nutshell it argues that the makeover of the Indian economy is still a work in progress, and its best is yet to come.

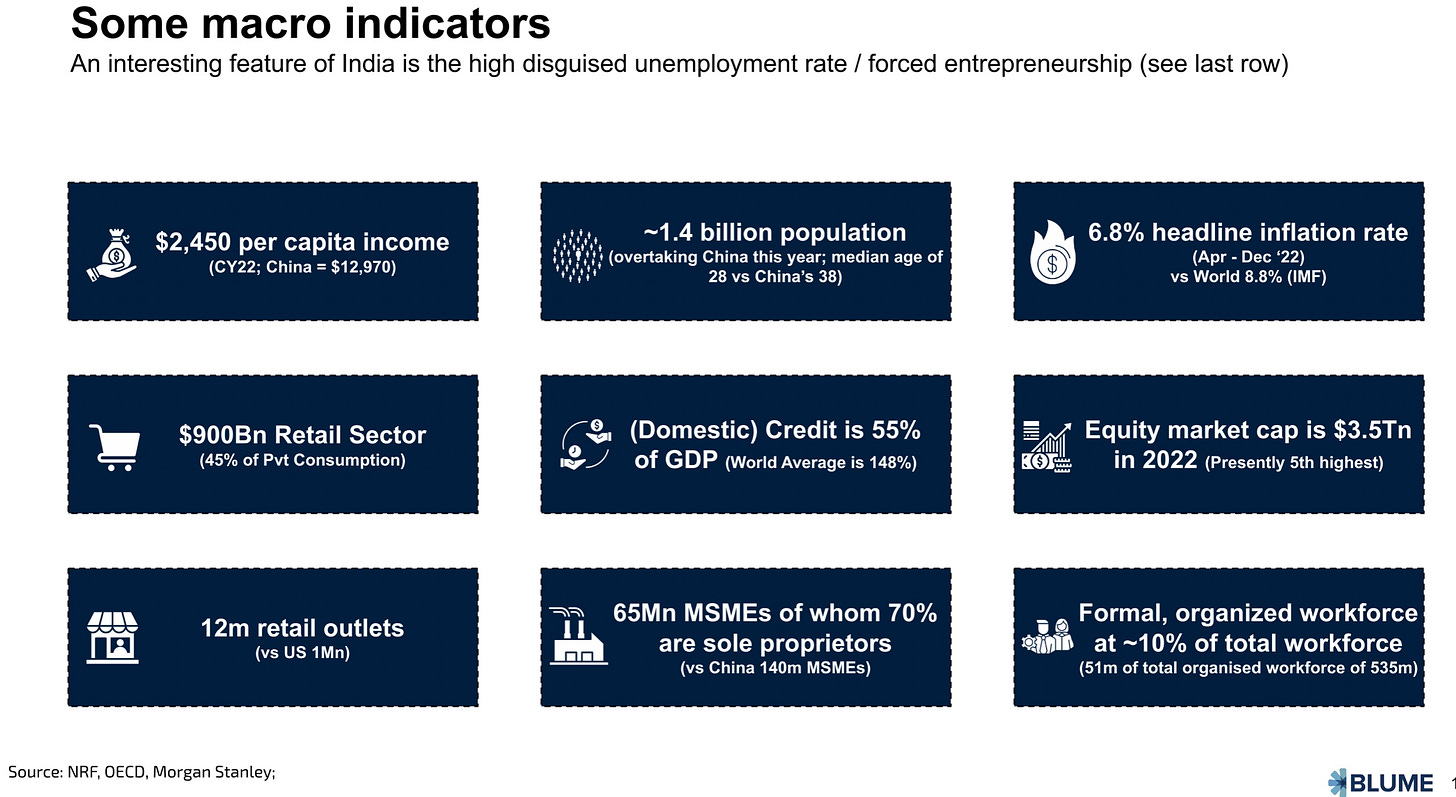

Take a look at the chart sourced from the Report.

The best part of the Indus Valley report, in my view, is how it identifies the layers that go to make up India.

An overall picture of the country conveys the snapshot shared above—which actually hides more than it shows.

However, an India divvied into an India-1 of 120 million people ($12,000 per capita income); India-2 of 100 million people ($3,000 per capita income); and, India-3 o f 1.2 billion people ($1,500 per capita income), unpacks the story of a country operating at different speeds and needs.

India-1, the report adds, includes 25 million people with a per capita income of a very impressive $35,000.

Not only does this structuring reveal the dynamics of the Indian economy, it also explains as to how investors often misread the market by looking at the overall numbers, rather than this disaggregated consumer stack.

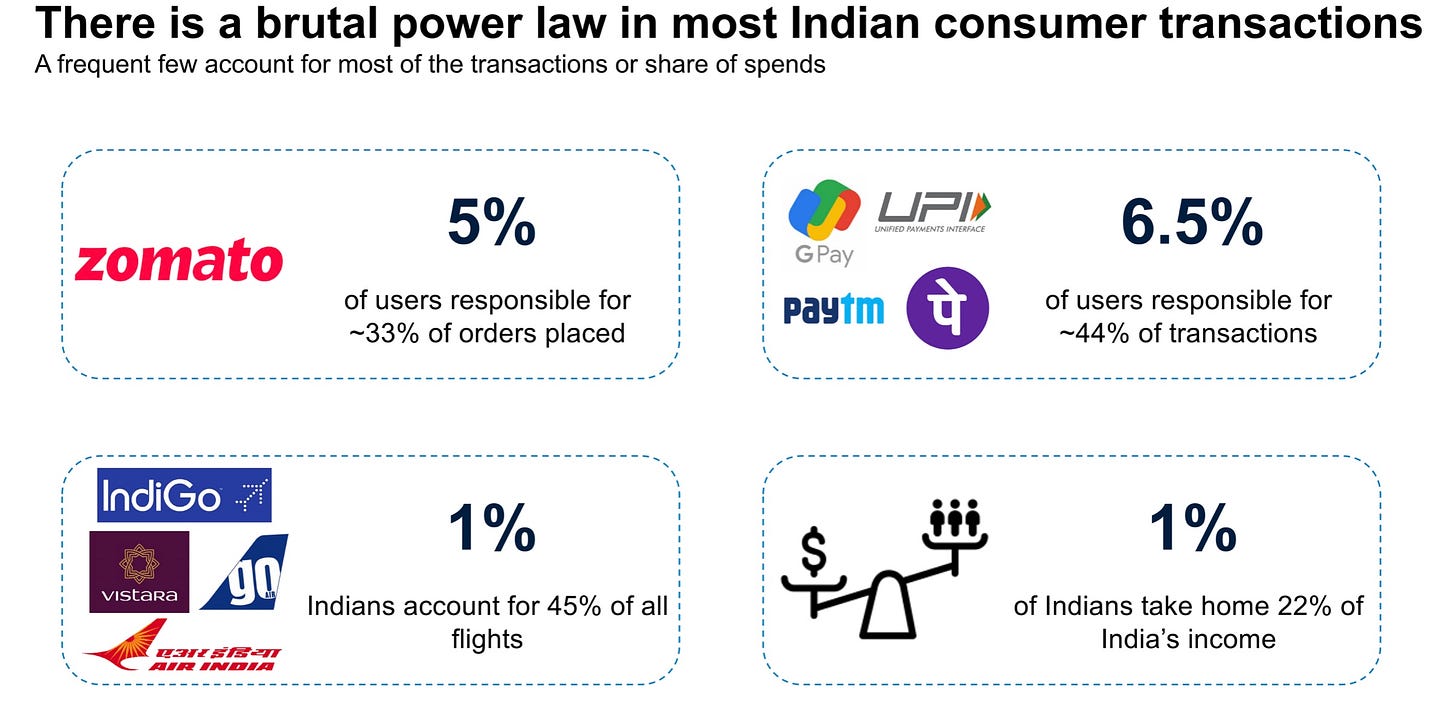

Check out the following graphic:

The Indian consumer story so far is, unfortunately, the power of few. Exactly why it is a work in progress. I would say a cup that is half-full.

It will be tempting to make strong conclusions about inequality from the above graphic. Actually it is nothing but a sorry record of decades of neglect, wherein people denied basic material needs like electricity, food, water, housing, cooking gas and so on were consigned to living below the poverty line.

The India-3 (as Sajith explains in the interview) has witnessed a rapid expansion after a record 430 million were pulled out of poverty between 2005-2021. Yes, they are out of extreme poverty, but they still do not command purchasing power to be part of India’s consumer economy.

Presumably, their lot will change as the strategy to provide material basic needs proceeds slowly and steadily to attain saturation levels. It will be a long haul, but one has cause for hope.

The India Way

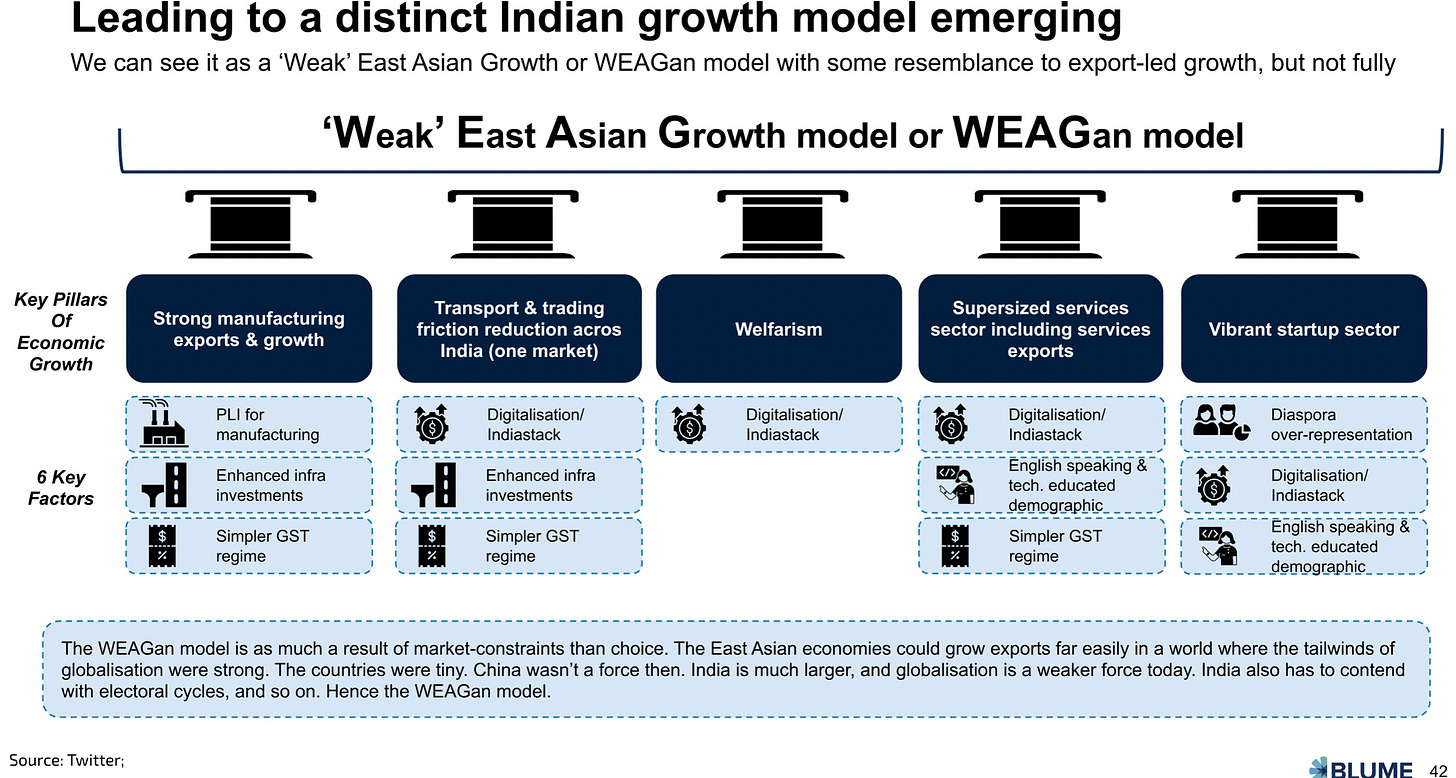

Now that we have the backdrop, it is time to take a closer look at the report, which argues that India’s innovation path is unique. Importantly, it has moved startups to the front and centre of this rapid transformation of the Indian economy.

The graphic above, sourced from the Indus Valley Report, very pithily sums up the model inspiring the growth of ‘New India’.

A big reason is the Digital Public Infrastructure that India has spawned. These digital highways eliminate entry costs and allows innovators to focus on creating products that ride on this digital public infrastructure. A great example is the way payments took off with UPI as the base. Today, India is recording 1,500 UPI transactions per second.

Further, unlike the East Asian countries, India does not enjoy the benefits of global trade tail-winds. Which is what makes the domestic consumer economy super important; at the moment, India’s consumer economy is firing on one cylinder—India-1—and this is not sustainable.

Policy tweaks, like the introduction of Goods and Services Tax (inspiring the idea of ‘One Nation, One Tax’), digitalisation using the Digital Public Infrastructure, have reduced, if not eliminated, friction in the economy. Further, the resulting disintermediation and formalisation is also reducing corruption, which in turn further prunes the diseconomies faced by Indian enterprises.

Another good example is the generation of startups that have sprung up to exploit the potential that arises from grouping the collective economic power of small and medium enterprises (SMEs). Not only is it good business for them, it is also drawing these enterprises into the mainstream.

Zetwerk (industrial products, apparel), nexprt (home decor), Groyyo (apparel), FASHiNZA (apparel) are manufacturing tech startups that have aggregated demand and then created cloud factories—parallel manufacturing— for SMEs to manufacture these products.

The Gig Class

The impact of Indian startups is clearly visible in one metric: They account for 10% of the white collar workforce. And, all this in a span of less than a decade.

Check out the graphic above and it is clear that the gig labour force has almost doubled in the last five years. Indeed, this is the low end of the pecking order of jobs; but in the current circumstances it is the vehicle for trading up.

Sajith has a nice moniker to describe the new found status of the Indian startup ecosystem: The New IT sector.

Only appropriate that I let him have the last word:

“The startup ecosystem accounts for a significant proportion of jobs. And increasingly, the growth of lower middle class jobs, the gig economy jobs, and we've said as many as a million white collar jobs, and as many as 4 million gig jobs are being driven by the startup ecosystem.

So these are all reasons why we say that the startup ecosystem is not a cute part of the Indian economy anymore, it's a sizeable part of the economy, and in the coming years will actually be even more sizeable.

Think of it as a new IT sector.”

Recommended Viewing

Sharing the latest episode of Capital Calculus on StratNews Global.

As promised, this is the episode I did with Sajith Pai, seed investor at Bloom Ventures and co-author of the Indus Valley Report. It is packed with insights.

Was particularly struck by Sajith’s characterisation of the various India’s. And that the material empowerment, undertaken over the last decade, will at some stage turn this country of 1.4 billion people into valuable consumers—giving fresh impetus to the Indian consumer economy.

“I am a big believer in the principle of compounding. All the initiatives that you mentioned—the improvement in electricity, which is very critical, the improvement in roads and water access—is steadily removing Indians from deep poverty (430 million people have been lifted out of poverty since 2005) into what I would say are the lowest rungs of the middle class.”

Do watch. Sharing the link below.

Till we meet again next week, stay safe.

Dear Anil,

Very informative article. The description by Sajith of India 1, 2 and 3 is very interesting!

Last few years have been very turbulent for our economy especially due to the Pandemic.Many strong entrepreneurs dived into new business opportunities, tested their ideas and were successful.India supports the rise of start ups due to its low cost skilled labour, funding from international and national investors and diverse growth opportunities.

Top gainers have been the fintech and financial services, retail and e-commerce and ed tech companies.At present there are around 105 unicorns, including health care services.The emergence of these startups is driven by millions of new customers in India and new international presence of India ..Let's hope it is able to solve the most serious problem of vast unemployment and disguised unemployment in the country.

Hi Anil !

I have my reservations on all the inferences which are being drawn from Indus valley report . The reservations arise from the statistics used and analysis done on that . While the start ups have helped democratise the economic structure , it is pre mature to assess its impact as significant on the macro economy . The percentage of failures among the Units which arose is significantly high for to be ignored , Probably the lack of regulatory framework , not necessarily of the Government , need to be looked at .

I will like to go back to your deep understanding, as to highlight the three real accelerators of the present times of the Indian Economy;

Digitisation

GST

World'sbest combat strategy against Covid Pandemic devised in India

Sorry for the dissent .

regards