The Growth Gambit

Budget 2025 is a bold and welcome bet, which for the first time prioritises economic growth over maximising revenue to the exchequer. EPISODE #212

Dear Reader,

A very happy Monday to you.

Over the weekend, Finance Minister Nirmala Sitharaman presented her eighth successive Union Budget—a record in itself.

In last week’s newsletter I had argued that exigent circumstances dictated the FM’s task: restoring India’s growth mojo.

She did not disappoint. Even better, her blueprint to restore the growth momentum, entails a structural break from the past. It also showed that this government has not lost its appetite to take risks.

In the past, cramped for fiscal space, FM’s always prioritised revenues—a hangover from the colonial past wherein the British employed harsh means to extract tax revenues.

Instead, FM Sitharaman boldly reduced direct tax rates—entailing a giveaway of Rs1 lakh crore. The big bet here is that this will spur economic activity, broaden the tax base, and encourage compliance.

More importantly, this strategy recognises that revenues are a byproduct of growth and hence higher growth will pay for itself—the theme of this week’s newsletter.

The cover picture of a confident FM striding into Parliament is sourced from PIB.

Happy reading.

The New Deal

Shortly after Finance Minister Nirmala Sitharaman finished presenting her eighth successive Union Budget, Prime Minister Narendra Modi shared his customary remarks. Capturing the essence of the budget, the PM said (This is the English translation of the original comments delivered in Hindi):

“Usually the focus of the budget is on how the government's treasury will be filled, but this budget is exactly the opposite.

This budget lays a very strong foundation on how the pockets of the citizens of the country will be filled, how the savings of the citizens of the country will increase and how the citizens of the country will become partners in development.”

By adopting this refreshingly new approach, the Prime Minister signalled a new fiscal strategy: One in which revenue is a byproduct of growth.

Indeed, this is a very bold bet, which assumes that lower rates will spur economic activity, broaden the tax base, and disincentivise tax evasion.

In other words, this government firmly believes that the time has come to move to a tax regime that emphasises lower rates and combine it with a soft touch on regulation to stimulate the animal spirits and consumption levels in the economy. Needless to say that this in turn will spur economic growth.

The government has the advantage of hindsight. A similar experiment with corporate tax rates undertaken in 2019 did not impact the government exchequer. And post-Budget interviews with the FM reveal that the biggest stumbling block was to convince the bureaucracy—whose machinations are threatening to undermine India’s biggest tax reform ever, the Goods and Services Tax (GST).

And, given the heavy lifting undertaken over the last decade to spread economic empowerment—by providing access to basics like electricity, education, health care, banking, cooking gas, drinking water and so on—the country has developed a strong foundation. As a result, the populace is better equipped to take advantage of the opportunities inherent in a fresh growth surge.

This is the FM’s growth gambit. Frankly, it is an unbelievably bold bet. To go somewhere where no FM has gone before.

Especially, since the downside risks this year are considerable. The headwinds facing the Indian economy, both from within and outside, are inclement and could potentially play havoc with the FM’s fiscal math.

The Colonial Legacy

One of the biggest drawbacks of the annual budget exercise, prior to FM Sitharaman’s latest essay, was the business of setting revenue targets for the year. Since expenditure is inelastic, the only way to balance the fisc is by raising revenues. Unfortunately, this often led to mindless tax overreach.

Worse, the tax framework did not keep pace with the transformation of the Indian economy—in just two decades the Indian economy has grown seven-fold to $3.5 trillion. Together with an aggressive tax regime this was beginning to take a toll on economic activity. Worse, honest tax payers coping with sell-past-the-date public services felt aggrieved twice over.

Last year’s winners of the Nobel prize, trace this inadequacy to colonial rule. I wrote about it last week in my monthly column in the Economic Times (have also shared the screen grab above). Sharing a teaser below:

“The work of the 2024 Nobel Prize winners in economics—Daron Acemoglu and Simon Johnson from the Massachusetts Institute of Technology, along with James A. Robinson from the University of Chicago—offers valuable insights.

These scholars argue that India inherited colonial-era institutions designed primarily for revenue extraction, and unfortunately, these frameworks were perpetuated post-Independence. Over time, powerful political groups have ringfenced these institutions, preventing much-needed reforms. And if they do come under pressure, this cabal allows for incremental reforms which do not disturb the status quo.

Worryingly, these outdated frameworks that have shaped domestic institutions since Independence are preventing or slowing down the process of democratisation of power, even though socio-economic conditions have steadily improved.”

Suffice to say that the FM took a big step forward to effect a course correction in this budget.

The Middle Class Bonanza

The big headline of this year’s budget is the tax bonanza the FM served up for the middle class—effectively no income tax on an annual income of Rs12 lakh. The majority of the middle class has been hurting due to severe economic stress induced by the economic shocks following the covid-19 pandemic. More money in their pockets will alleviate some of this economic pain.

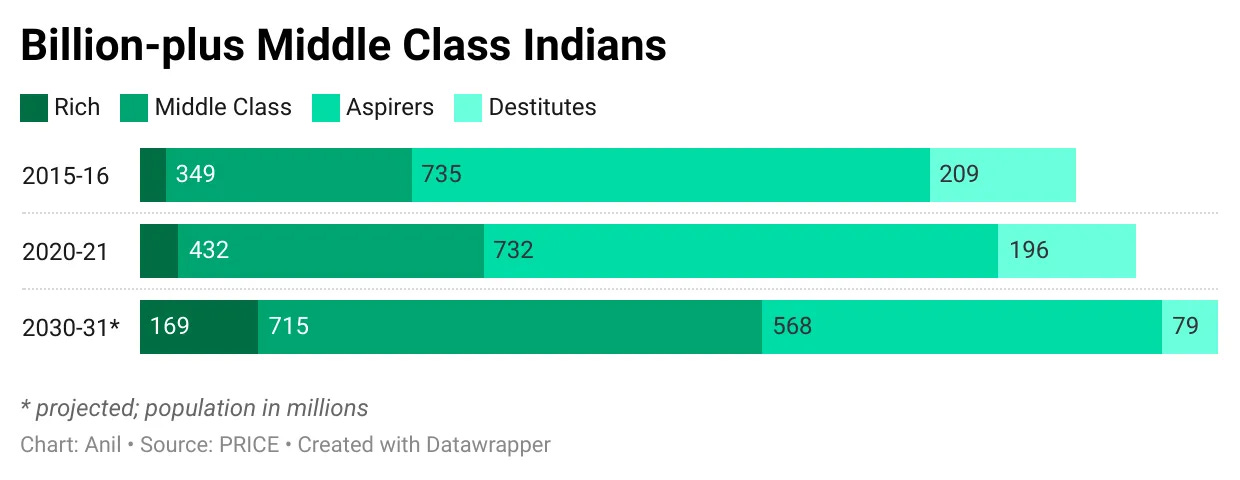

As the above graphic, sourced from PRICE (People’s Research on the Indian Consumer Economy), shows, the middle class cohort is substantial. At present, they are estimated to be around 40-50 crore and are projected to grow to 71.5 crore by 2030. To be sure the middle class is not a homogenous entity and is variegated across income groups.

According to PRICE, the middle class is already the biggest contributor to national well being. They account for:

50% of income;

48% of spending;

and, 52% of savings.

And not to forget, 50% of this cohort are women—who as I have argued in several newsletters are acquiring a mind of their own. Both, numerically and politically, the middle class is therefore a cohort that cannot be ignored. This year’s budget has put them on centre stage.

But, we need to see this in context. Two years ago, FM Sitharaman acknowledged that the middle class no longer required to be guided in their investment decisions by the government—either mandatorily or by incentivising investments through tax concessions.

Today, for one there are there are a gazillion investment options for investors. Further, unlike in the past, the risk taking behaviour of the middle class has witnessed an unprecedented spurt. This is more than apparent in the near five-fold growth in demat accounts in the last five years to 18.5 crore.

Accordingly, the FM introduced the new tax regime sans tax sops. This enabled her to offer lower rates compared to the old regime; no surprise that 75% of tax payers have shifted to the new tax framework.

In a post-budget interview granted to The Open magazine, FM Sitharaman, in response to a pointed question on the logic of the new tax slabs sans tax sops, said as much:

“Yes, absolutely! That is what I also tell people who say that because of the emphasis on the new tax regime I have disincentivised investment, insurance, and so on.

My reply is that I don’t think we should judge the assessee. If a person has more money in hand, then such a person can figure out where to put it or how to use it; rather than saying that incentive lies in a particular option. A person can prioritise for his family. How can the government be the better judge?

So these changes give confidence to income taxpayers that they have more money post-tax and they know what to do with it.”

The FM shared great insight here. She is arguing that one size does not fit all. It worked in an old India where there were few options and hence risks were steep. Further, disposable incomes were hard to come by and inducements like tax breaks were used to incentivise the middle class to save.

Today, the middle class is mature enough to decide on how to save. Exactly why she is confidently transferring Rs1 lakh crore to the wallets of the middle class. According to government officials, the tax rebate together with the lower tax slabs would mean that one crore more people will not pay taxes.

The New Stakeholders

If you recall the prime minister had emphasised that the tax giveaway would create new stakeholders in the Indian economy. He is right. This trend is already in the making. We have witnessed how the middle class has traded-up in the last decade. This budget is likely to tip the scales further.

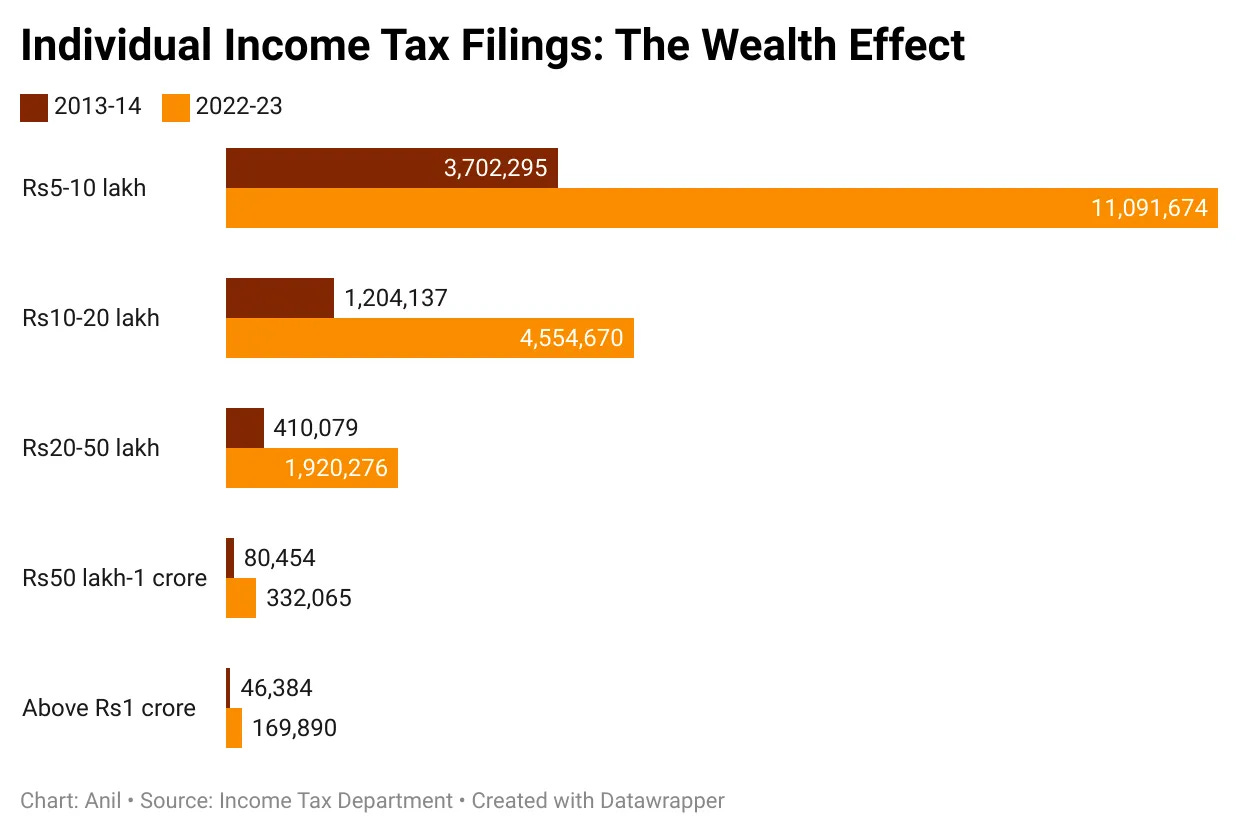

I had done a newsletter two years ago capturing this wealth effect through the prism of income tax filings.

Sharing it below, in case you wish to re-read it.

The graphic shared above is sourced from the same newsletter. It shows how there was a substantial jump in the number of tax filings for annual income in the band of Rs 5-10 lakh and Rs 10-20 lakh. The new tax bands announced by the FM tacitly acknowledge this trading up by eliminating the tax incidence on incomes less than Rs12 lakh.

In the final analysis it is clear that the finance minister has demonstrated both courage and vision by effecting the boldest makeover of the income tax regime. Hopefully, she will now proceed to convince her fellow FM’s in the GST Council to close out the unfinished agenda of rationalising rates and tax bands.

It would go a long way in strengthening the Indian economy. Remember that India’s best defence against a volatile world led by President Donal Trump, is a strong domestic economy.

Recommended Viewing

Sharing the latest episode of Capital Calculus.

In the run up to this year’s Union Budget, a chorus of voices made out a case against tax overreach. Some even called it tax terrorism. Many, including the former revenue secretary, believe that this mindless tax overreach was killing investment interest and causing some to relocate their business abroad.

To unpack this vexing problem I spoke to Arvind Datar, Senior Advocate in the Supreme Court. Mr Datar confirmed my worst fears. His solution was very simple: stop fixing annual revenue targets. In other words treat revenue as a byproduct of economic growth. Coincidentally, this year’s Budget chose to do this. Sharing the link below.

Do watch.

Till we meet again next week, stay safe.

Thank You!

Finally, a big shoutout to Gautam for his informed response, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all readers. Gratitude to all those who responded on Twitter (X) and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I will be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

One of your best articles Anil; I suppose the challenging topic, brought out the best in you and provided your readers, a lot to think about. This budget has been well thought out and has skillfully tried to address the issues that may be faced in the future. It is clear now that India has to focus on the domestic consumption mainly, for survival and growth. Prudence has been shown by lowering import duty on Harley Davidson motorcycles (an irritant for Trump, during his last tenure, as the Co. is from his home state) and also Tesla, as it is important to be friends with Elon Musk. The Sabre rattling by Trump is indicative of a no quarter given policy by the new Government in the US. Hence, the pragmatic approach of depending on the domestic consumer for growth, is I feel, the correct way to go. The FM, mentioned about the foremost allocation to Defence, stating that over 60% of the procurement of Defence equipment is indigenous and further, that the Defence equipment production is also a lucrative export of India. Only some critical hi tech equipment is being imported. The investment allocation to infrastructure development continues; which will also provide employment. Inspite of the intent and thoughtful relief to the long neglected middle class, it remains to be seen how this budget works for the nation. Thank you for sharing an excellent write up.

Excellent budget, very well explained and highlighted, things you had already mentioned in your column "Don’t let the tail wag the dog", to boost the economy. Brilliant 👏