Resilient India

The Indian economy has honed the mantra of resilience to thrive in the chaos of back-to-back economic shocks and bounce forward to grow at 7.3%. EPISODE #159

Dear Reader,

A very Happy New Year to you.

Last week’s newsletter was on the rewiring of India focusing on the millions who joined the formal economy in the last decade. This week I propose to put the spotlight on another fascinating, less discussed trait of the Indian economy: resilience.

It is a quality that explains the Indian economy’s ability to ride out the shocks unleashed since the covid-19 pandemic and then stage a stunning recovery. In fact, the chief economist of Axis Bank, Neelkanth Mishra, says that the Indian economy (watch interview enclosed below) is poised to strike out on a higher growth trajectory of 7%.

Nassim Taleb—the mathematician and former options trader who penned the cult book, Black Swan, which challenged conventional financial models—coined a term for this phenomena: anti-fragile. Resilient countries, institutions, companies, and individuals can hold their own in the emerging era dominated by disruptions.

Do read and share your feedback.

The cover picture captures the prevailing winter weather conditions across North India and is taken by Arto Suraj and sourced from Unsplash.

A big shoutout to Surendra, Aashish, Lakshmisha, Vandana, Ranjini, Premasundaran and Gautam for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all you readers. Gratitude also to all those who responded on Twitter and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I would be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

Dialling Resilience

As we approach the fourth anniversary of the covid-19 pandemic in India the horrors of that period flash across our minds. The World Health Organisation had declared covid-19 as a pandemic on 11 March 2020.

What started out as a health crisis quickly snowballed into an unprecedented global economic challenge. This was just the beginning.

The once in a century pandemic was followed by back-to-back economic shocks. The Russia-Ukraine war further upended global supply chains, particularly for crude oil and food grains. This unleashed global inflation, last witnessed in the 1960s, forcing the US Federal Reserve Board to ratchet up interest rates in a record fashion. This in turn sucked out global liquidity and forced a sharp appreciation of the US dollar at the expense of other international currencies (including the rupee)—exporting inflation to the rest of the world.

These unprecedented back-to-back shocks savaged the global economy and brought several countries, including the United States, on the brink of a recession. It was natural then to expect only the worst for the Indian economy too.

However, in relative terms, India fared well and is now the fastest growing large economy.

See the graphic below sourced from NCAER that stacks the official projection (7.3%) against other independent estimates, including those put out by multilateral institutions.

Clearly, India saw off the worst—the scars of which are most visible at the bottom of the pyramid—of the covid-19 pandemic and subsequent economic shocks. Thereafter it staged a smart recovery and is now officially projected to grow at a very impressive 7.3% in the current fiscal year.

Not only did India survive this extremely difficult challenge, but it demonstrated a remarkable trait: resilience. And like all good resilient organisations, India did not just bounce back. Instead it bounced forward.

New Mantra

World wide resilience is the new mantra being proffered to countries, institutions, companies and every economic entity. This is because disruptions have been normalised and the future belongs to those who develop resilience.

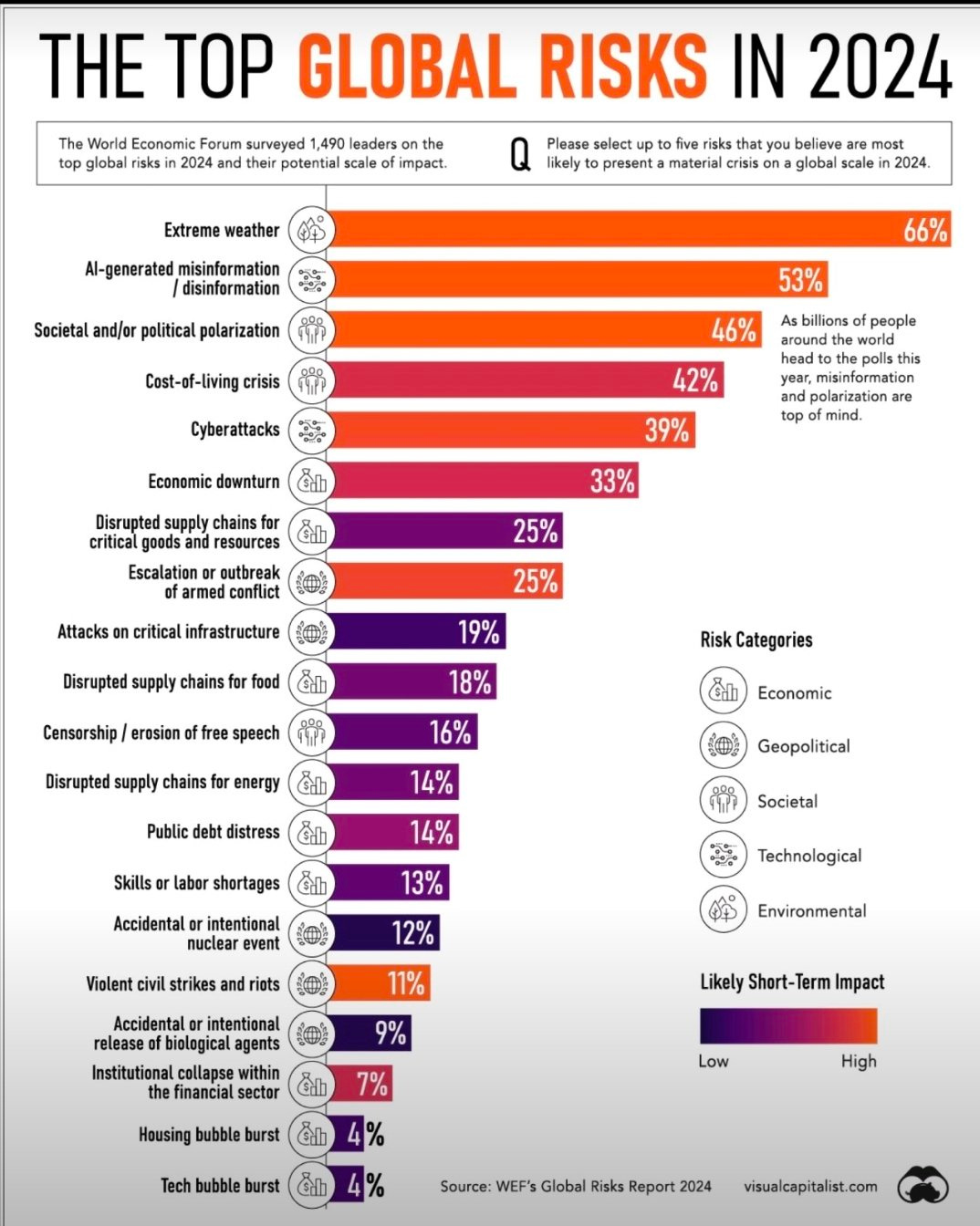

If not geopolitics, it will be climate change—we are already witnessing the fallout in extreme weather conditions—or another pandemic. In short disruptions are now par for the course. Check out the graphic above, sourced from the World Economic Forum, capturing the risks facing the world.

In India’s instance this resilience has been honed over the last few decades through a painful process of trial and error. It is my argument that growth in resilience is directly proportional to a greater role for markets. Especially since, what began as reforms by stealth is now part of the official lexicon.

Over the last four decades regimes have incrementally ensured a greater play for market forces, to replace the previously state-controlled economy—defined by the public sector as the commanding heights of the Indian economy and the infamous Licence Raj.

But it is only in the last decade that reforms have ceased to be a dirty word. To its credit the Bharatiya Janata Party (BJP)-led National Democratic Alliance (NDA) has managed to overcome reactionary politics (remember “suit-boot ki sarkar” jibe) that comes with the embrace of market economics by walking the talk on its slogan of “pro-poor and pro-business”.

By delivering on basics—like banking, electricity, cooking gas, housing, drinking water and so on—denied for most of the last seven decades the NDA developed its trust quotient with the public. NDA proved that development, using what we assumed was the same broken system, could be delivered by targeting welfare through the use of an economic GPS (using an individual’s bank account, Aadhaar and mobile to triangulate a beneficiary); a collateral gain is that it prevented leakages, saving Rs 2.75 lakh crore to the national exchequer.

This also meant that there were more people inside the economy looking out, rather than the other way around. In other words, there were more people with a stake in the future growth of the Indian economy. This proof of concept also became easier for the government to fend off political attacks; more importantly pursue pro-business policy without looking over its shoulder.

To be sure, while due credit has to be given to the NDA for rewriting the political economy of India, it is also a fact that it evolved over several decades.

India’s decision to pivot from a state-controlled economy to one based more on market forces was initiated in 1980 when India rolled out its Sixth Plan. Ironically, this happened under the leadership of Prime Minister Indira Gandhi, the Congress leader who had turned populism into a fine art.

Thereafter subsequent governments kept chipping away at the old regime, till the benchmark moment in 1991—when India in the throes of an external crisis decided to go the whole distance and dismantled the Licence Raj under another Congress regime, this time led by Prime Minister Narasimha Rao.

Indeed this was the turning point. The country never looked back. Today it is no longer a case of reforms by stealth. Instead in the last decade it is one based on conviction.

This greater play for market forces through structural reforms allowed economic shocks to work their way through the system. Earlier this was resolved through government interventions which created distortions, often making a bad situation worse.

For instance the oil shock of 1971 devastated the world and the Indian economy. Till then prices of petrol at the pump was administratively controlled. The oil shock blew the subsidy bill out of proportion putting pressure on the exchequer. The shift to more market determined rates began in 1998 when the government first initiated dismantling of administered prices for petroleum products.

Even today the government does influence prices at petrol pumps, but certainly not to the degree witnessed in the 1970s. More importantly the pain point of higher fuel prices is now partially shared with the consumer.

Reforms Central

The Reserve Bank of India (RBI) governor Shaktikanta Das dwelled on India’s resilience in his latest credit policy review held last month and in an address in November last year at the symposium on the Indian economy hosted by the Tokyo Chamber of Commerce and Industry.

Addressing the gathering in Tokyo, the RBI Governor summed up the factors underlying India’s resilience:

“The innate resilience of the Indian economy could be attributed to its well diversified economic structure.

Although India has made rapid strides in external openness through trade and financial channels and gained competitiveness, its core dependence for growth continues to be its domestic demand which also provides a cushion against external shocks.”

And, then added:

“Structural reforms related to banking (especially the bankruptcy code that has solved for the vexing challenge of industrial sickness), digitalisation (the rapid rise of UPI), taxation (corporate tax rates today compare to international levels), manufacturing (launch of PLIs or performance linked incentives), etc., have laid the foundation for a strong and sustainable growth over the medium and long term.”

All the reforms listed by the governor improved ease of doing business and most importantly reduced friction in the Indian economy—improved plumbing ensures more bang for the buck, a key factor improving resilience.

Similarly, the International Monetary Fund (IMF) in its latest review of the Indian economy under the so-called Article IV consultations released last month, took note of this trait of the Indian economy while commending the country for “their prudent macroeconomic policies and reforms that resulted in the (Indian) economy’s strong economic performance, resilience, and financial stability, while also facing continued global headwinds”.

Clearly, India has demonstrated its resilience to absorb not just isolated shocks, but also when they happen together. Does this mean that India is immune to shocks? Of course not. But as long as it remains resilient it has the ability to recover and thrive from such shocks.

A very desirable quality in an era where economic shocks will be the rule rather than the exception.

Recommended Viewing/Reading

Sharing the latest post of Capital Calculus on StratNews Global.

Over the last week and more we have been inundated with news and reports about the Indian economy. They had a common thread—a stunning economic recovery.

The analysis by Axis Bank stood out though. It very boldly stuck its neck out and argued that India was entering a new growth trajectory of 7%—as opposed to the 6% previously. Subsequently, the government released its forecast for 2023-24: pegging economic growth rate at 7.3% for the current fiscal.

A new trend rate of growth is a big structural shift. Faster economic growth means economic milestones like at $7.2 trillion economy by 2030 will be achieved earlier. It also means more revenues to the exchequer and hence more resources to fund development for the millions of Indians playing catch up.

To unpack all this and more I spoke to Neelkanth Mishra, chief economist of Axis Bank and part of the Prime Minister’s Economic Advisory Council (PMEAC).

Sharing the link below. Do watch and share your thoughts.

Till we meet again next week, stay safe.

Interesting article Anil and the interview with the economist from Axis Bank, was also skillfully conducted. While comparing with the rest of the world, India definitely can give itself a generous pat on the back ; however in the current situation, the US economy has shown unexpected resilience, I feel. China always managed to pip us to the post in race for fastest growth, but somehow they have lost their way, this time; and their aggressive behavior is partly to blame. Japan and Germany, the other economies ahead of India are entering recession but US has managed to bounce back and with the prospect of arms sales, in view of the current geopolitical situation, their future, along with some of the other arms exporting countries, is set to revive. But the per capita income of these countries is way above India and the real challenge for India, as I perceive, will come after the 8 trn $ line is breached. So for the next decade India should be able to keep it's nose in front and keep on growing at the fastest rate. With this government in the saddle, India has come out of the hibernation induced by self serving political parties and leaders. Barring an internal chaos or external aggression, I don't forsee a change in course. Thank you Anil, for a thought provoking article.

While resilience is the buzz word in banking, finance and risk management, we must note that Indian economy appears resilient due to the policies of Modi Govt. Had there been any other Govt, it could have been a different story. If Modi continues for another decade, we can certainly hope to have governance in place which would be strongly resilient fir years to come.