RBI Plays Defence

Within days of Trump-tariffs unleashing mayhem on global financial markets, RBI undertook a pivot, prioritising growth over inflation. EPISODE #222

Dear Reader,

A very happy Monday to you.

In the aftermath of the devastating impact of Trump-tariffs, the Reserve Bank of India (RBI) changed gears as it were. It moved to reposition monetary policy to prioritise growth over inflation.

This week I will unpack the motivations and implications of RBI’s actions for India’s growth trajectory. The cover pix is a screen grab from the RBI press conference.

Happy reading.

Growth over Inflation

Last week, the Reserve Bank of India (RBI), the country’s central bank, signalled a major course correction in its approach to monetary policy by prioritising economic growth. To be sure, beginning with the last review of the monetary policy, the central bank had begun to do so, albeit cautiously.

At that time, the newly appointed RBI Governor Sanjay Malhotra, had said (the bold text is my doing):

“The MPC (Monetary Policy Committee) also decided unanimously to continue with the neutral stance and remain unambiguously focussed on a durable alignment of inflation with the target, while supporting growth.”

And, last week, Malhotra switched the central bank’s priorities to say:

“The domestic growth-inflation trajectory demands monetary policy to be growth supportive, while being watchful on the inflation front.”

Further, monetary policy has pivoted from a neutral stance to “accommodative”; meaning that going forward, absent any shocks, the MPC is considering only two options—status quo or a rate cut. In short, RBI is pulling out all the stops to do its bit to support a revival in growth.

The motivations for RBI’s pivot are not difficult to comprehend.

Global uncertainties have compounded since President Trump initiated the second round of his tariff war against the rest of the world, particularly China—this face-off is rapidly degenerating into a farce, with both countries upping the ante on the level of tariffs; At present, US tariffs on Chinese imports is 145%, while Chinese tariffs on US exports is 125%.

The last time the world witnessed a tariff war was in 1930, which most believe contributed in nudging the world into its worst economic depression. At that time tariffs, mind you, jumped by a mere 20%.

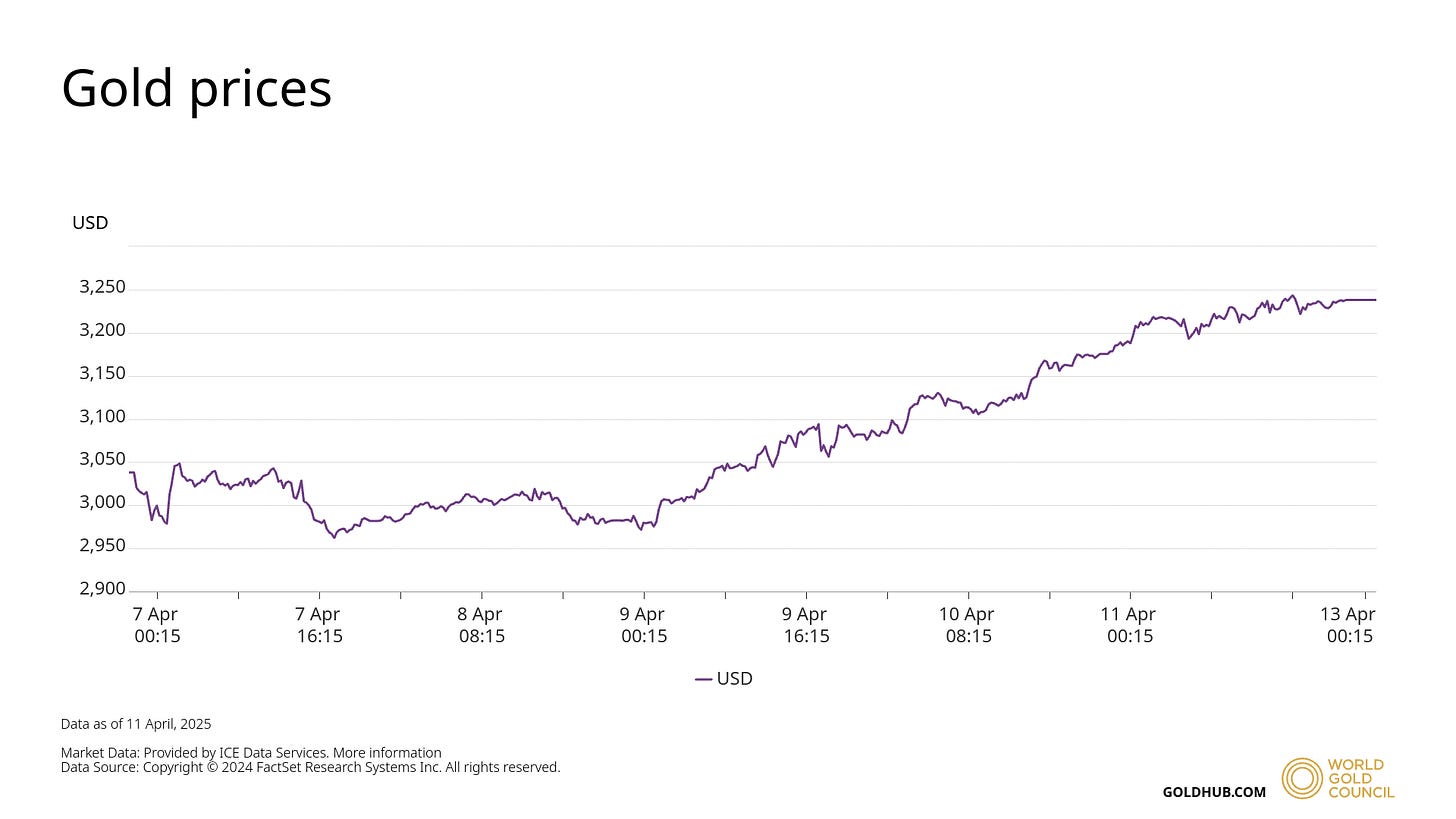

The best barometer for diminishing investor sentiment is the price of gold. In the week since the impact of Trump-tariffs started playing out, gold prices claimed fresh lifetime highs, closing at $3,237 per troy ounce.

Check out the graphic below, sourced from the World Gold Council.

Clearly, RBI is looking to mitigate the impact of the unpredictable Trump-tariffs blitz on India’s growth momentum—which was already losing steam. Interestingly, this move is in synch with the priorities of North Block, which in its Union Budget, presented on 1 February, prioritised growth.

In short, economic growth is now front and center of India’s policy planners.

The Growth Challenge

Even before the impact of Trump-tariffs started to kick-in, red flags were going up on the evident loss of India’s growth momentum. Don’t get me wrong. The country’s economic growth is still very, very impressive. Especially, if we consider what other countries are experiencing.

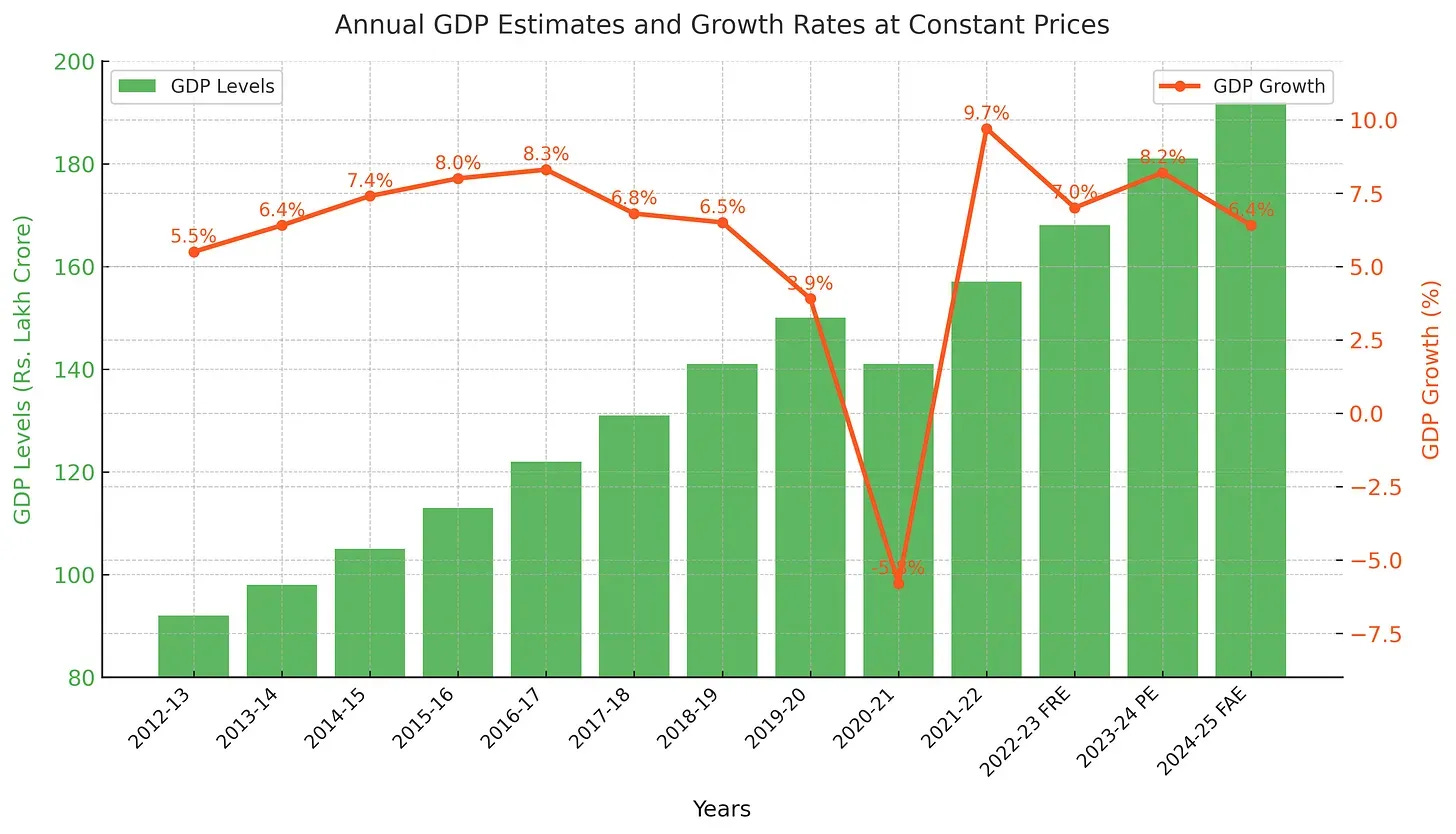

The thing is that India has set itself extremely high and exacting milestones—including transforming into a developed economy by 2047. To realise this ambition, India has to clock a minimum growth rate of 7%..

From the graphic above, it is apparent that for a host of reasons India’s economic growth has been losing steam. The onset of Trump-tariffs has only tipped the scales and forced the hand of India’s central bank.

In his statement, the RBI Governor pencilled in the impact of Trump-tariffs. Economic growth, which was projected at 6.7% for 2025-26 has now been pared down to 6.5%. Some analysts fear the actual growth may be lower and could well touch 6% in the current fiscal.

The fear that this loss in growth momentum can turn secular, forced the hand of RBI. The fact that the inflation outlook turned benign, helped no doubt; in fact, RBI has projected the average inflation for 2025-26 at 4%.

RBI-MoF Tango

The good news is that RBI’s actions are in synch with that of the Ministry of Finance. This trend had resumed with the onset of the covid-19 pandemic—in previous years the two had often been at odds, and at times engaged in acerbic public duels (during the tenure of Raghuram Rajan and Urjit Patel).

There is every reason to believe that both institutions have learnt their lessons and are coordinating their responses to prioritise growth as the most pressing policy objective. While RBI is providing a benign ecosystem by cutting interest rates and promising adequate liquidity conditions, North Block is helming economic reforms with the unstated promise of using its fiscal capacity if push comes to shove later in the Trump era.

I wrote about this just after the presentation of this year’s Union Budget and hence won’t repeat myself. If anything, the ascent of Trump has only strengthened this coordination.

Sharing the link below, in case you wish to re-read it.

To sum up then, the world economy in general and India in particular are up against a fresh economic challenge. This challenge is particularly acute, since the world is deeply divided and multilateral institutions that coordinated global responses have been hollowed out or rendered ineffective. Further, the United States is no longer the anchor of the world.

The good news is that India’s policy planners are taking preemptive action. Staying ahead of the curve as it were and not being reactionary in their responses. But so far, they have only plucked the low hanging fruit. The worst kept secret is that India has to roll out hard-nosed and politically difficult reforms. The window for this is rapidly shrinking.

Over to South Block.

Recommended Viewing/Reading

Sharing the latest episode of Capital Calculus. (Please note that Capital Calculus has moved to a new home (stratnewsglobal.tech) within StratNews Global. This relocation will take a bit of getting used to—bear with me.)

Little over a week ago, leaders of BIMSTEC (Bay of Bengal Initiative for Multi Sectoral and Technical Cooperation) countries, converged in Bangkok to attempt a fresh start to revive this regional body consisting of countries flanking the Bay of Bengal.

Coincidentally, the meeting took place around the time when the world was soaking up the fallout of Act-II of President Donald Trump’s tariff war. Most analysts fear that the US action could hurt the world economy, particularly global trade. Not surprisingly, global sentiment has taken a beating with stock markets in a nosedive.

The move to revive BIMSTEC, which has been around since 1997, comes in this backdrop. It begs the obvious question: Will it work? Why is India so invested in BIMSTEC? To answer all this and more, I spoke to Sachin Chaturvedi, Director General, Research and Information System.

In a very candid conversation, Sachin argued that it is now or never. And added, that it is imperative India simultaneously works to improve competitiveness of domestic industry on a war footing. This ask includes dealing with tax and regulatory overreach. Any delay could be catastrophic.

Do watch. Sharing the link below.

I also wanted to plug a recently launched newsletter on Substack, Leading the Flux.

It is authored by Debu Mishra, one of the finest management and organisation gurus I have known. Full disclosure, Debu is also a dear friend.

‘Leading the Flux’ focuses on the intersection of neuroscience and vedanta philosophy to explore vexing questions that managements have to deal with in a world witnessing unprecedented uncertainty.

Sharing the first episode below.

Till we meet again next week, stay safe.

Thank You!

Finally, a big shoutout to Debu, Gautam, Shipra, Sky Clipper, Balesh and David for their informed response, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all readers. Gratitude to all those who responded on Twitter (X) and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I will be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.