Is India's Economic Growth Slowing?

Latest data suggests a slowdown, but RBI says it is a blip and that the Indian economy's growth momentum is secure. EPISODE #193

Dear Reader,

A very happy Monday to you.

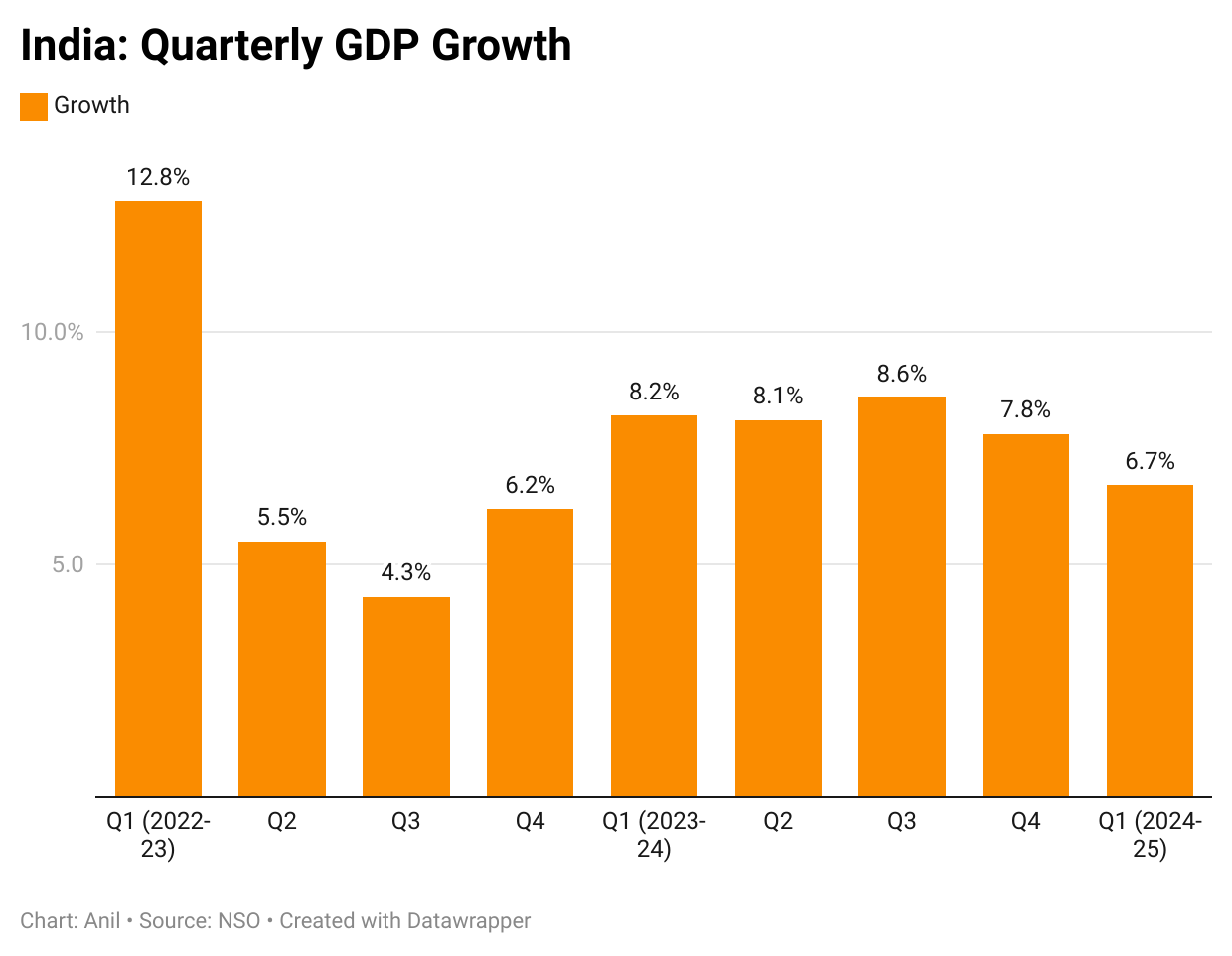

Last week the union government released the latest data on India’s gross domestic product (GDP). Economic growth at the end of the first quarter ended June for the current financial year was a shade below the projected 7.2%, prompting headlines that the Indian economy was slowing down.

However, two days later the Reserve Bank of India governor Shaktikanta Das dismissed these claims and argued that India’s growth momentum was intact. This week I unpack the growth numbers.

The cover picture is an interesting wall decor capturing a range of human emotions I came across in a mall.

Happy reading.

Q1 Story: Pause and Reflect

Last week the National Statistics Office (NSO) released the latest data on India’s gross domestic product (GDP). Growth rate, in real terms, came a tad below the 7.2% projected for the current fiscal year by the Reserve Bank of India (RBI), prompting headlines that the Indian economy was slowing down.

Sharing below a collage of select newspaper headlines.

The headlines are not incorrect. Indeed growth for the first quarter did slow down. But to extrapolate a slowdown for the entire year is a stretch. Especially since the Indian economy is witnessing a new trend trend rate of growth of 7%—as opposed to 5% previously.

A few days later, RBI Governor Shaktikanta Das summarily dismissed suggestions that there was any let up in growth.

Instead, he claimed the strong economic momentum, visible for the last six months, was intact and that Q1 growth number was an aberration—attributable to a slowdown in spending during the 18th general election which concluded in May.

“The NSO has placed India’s GDP growth at 6.7% in Q1 of 2024-25.

Notwithstanding the moderation in growth from the previous quarter and below our projection for Q1, the data shows that the fundamental growth drivers are gaining momentum.

This gives us confidence to say that the Indian growth story remains intact.”

According to the governor, excluding government expenditure—which took a hit during the election campaign—the growth in GDP in Q1 was 7.4%. In other words, as government spending picks up, now that the government is back in office, this growth impulse will be restored.

I would pay heed to what the governor is saying. For one, he is not loose lipped. In fact, if anything, he is thrifty with words and cautious to fault.

Second, he has a proven record of anticipating trends. You may recall, the governor was the first head of an institution to boldly assert last November that the economy was witnessing a surge in momentum and that growth in 2023-24 would be higher than what had been projected. Indeed, this is exactly what happened.

His address at the annual FIBAC conference in Mumbai on 5 September, jointly hosted by Ficci and IBA, underwrites India’s economic potential.

This is particularly reassuring as the ongoing political gamesmanship, playing out in the aftermath of the sharp fall in the numbers of the Bhartiya Janata Party (BJP)-led National Democratic Alliance (NDA) in the 18th general election, is disrupting the framing and rollout of policy.

This is despite the fact that the NDA has a comfortable majority in the Lok Sabha and a slender majority in the Rajya Sabha. The coalition is seemingly on the back foot as it no longer enjoys a single party majority with the BJP numbers in the Lok Sabha dropping from 303 to 240. I believe it is a political style quotient issue that is overwhelming the NDA at the moment.

Already, a feisty opposition has railroaded some reforms, including the move to laterally induct bureaucrats. Ironically, this happened within days of Prime Minister Narendra Modi promising hard-nosed economic reforms in his first Independence Day address in the third tenure of the NDA.

In fact, my latest episode on StratNews Global (shared at the end of this week’s newsletter), addresses these concerns about NDA 3.0.

In a very insightful conversation Rajeev Mantri, one of the most astute commentators on India, reminds us that this is a five-year government and we should not rush to judgement.

Sharing the promo below:

According to the governor, if we look beneath the hood as it were, we will see that key growth drivers—private consumption (accounting for 56% of GDP and investment (with a share of 35% in GDP)—are intact. While private consumption rose sharply to 7.4%, investment grew at 7.5% in Q1 ended June.

“Thus, more than 90% of GDP expanded at a robust pace and materially above 7%.”

The pick-up in both private consumption and investment, in the absence of government spending, is heartening. If this trend endures then the Indian economy will finally be powered by both engines—so far, much of the revival has been inspired by sustained government capital expenditure.

Downside Risks

Indeed while the economy is in a good place for now, there are downside risks that cannot be overlooked.

These mainly revolve around fluid geopolitics and the fact that the threat of inflation still lingers. Don’t get me wrong, the RBI has done well in lowering inflation to around 3.54% in July, but persistent food inflation is a cause for worry—hopefully a good Monsoon will stoke a revival in agriculture and consequently bolster rural demand. In fact, this is holding the RBI back from effecting a rate cut.

On the other hand, the world today is a far more dangerous place. The uncertainty in the US, especially its choice of the next President, only adds to the growing apprehensions.

As Gordon Brown, the former Prime Minister of the United Kingdom astutely pointed out, the world is transiting from a rules-based order to one that is power-based. In a world that is no longer unipolar, this makeover is dangerous and already visible in the many conflicts that are breaking out.

In his speech to the PIIE-IMF conference in April this year, PM Brown said:

“We have transitioned from free-for-all hyper-globalisation to globalisation that is more constrained, as security concerns as well as environmental and equity considerations must now be taken into account. Central banks are no longer the only game in town, and a power-based order is replacing a rules-based order.”

Ideas like friend-shoring promoted by the United States in its bid to isolate China is posing difficult choices for developing countries. Striking an independent path comes with consequences.

For example, India’s decision to ignore sanctions on Russia to secure its energy needs has invited a backlash from the American deep state. All this while India’s hands are full in dealing with an increasingly aggressive China.

At the moment the world is on a razor’s edge and the geopolitical risks are both unpredictable and difficult to gauge.

Point of Inflection

While this indeed the case, India’s best defence is in growing its economy. The Q1 numbers confirm that India is on the growth turnpike. I had written about this trend recently. Sharing the post below, in case you wish to re-read it.

The new trend rate of growth is signalling a structural shift in the economy. Achieving saturation access in basics like banking, electricity, cooking gas, drinking water and so on has enlisted 500 million new stakeholders in the economy. In other words there are fewer people outside the economy looking within, leading to a gradual broad basing of the economy.

In the same FIBAC address, the RBI governor said as much:

“As regards growth prospects in the medium to long-term, it is felt that the Indian economy is on the cusp of transformational shifts. The fact that growth is on a rising trend, despite modest global growth and continuing global challenges, shows that structural drivers are playing a bigger role in India’s macroeconomic outcomes. These drivers include: policy push on creating robust physical infrastructure; our fast growing digital public infrastructure; innovation and technological advancements across sectors; and critical reforms in key areas.”

While this is indeed the case, the worst kept secret is that India’s potential is presaged on its ability to rollout the long overdue next generation of reforms. One in which the states are equal stakeholders.

Unfortunately, at present politics is dictating economics. The political opposition is trying to ensure a logjam in Parliament and outside. In other words cooperative fiscal federalism is mere lip service.

The ball is in NDA’s court. As PM Modi often states: Reform, Perform and Transform. Sharing a clip below:

Needless to say, India’s economic future depends on the PM’s ability to walk the talk in the new political circumstances.

Recommended Viewing

Sharing the latest episode of Capital Calculus.

A week after Prime Minister Narendra Modi resolved to unleash politically difficult reforms from the ramparts of Red Fort, his government was forced to walk back the move to laterally induct domain experts in the bureaucracy. And this despite being a policy trend for decades. There couldn’t be worse optics.

Effectively, those backing status quo—within and outside government—gabe another bloody nose to a politically diminished government. Worse, they have successfully railroaded reform. Is this going to be the trend for the next five years? Is India at a greater risk of falling into the middle-income trap?

To answer these vexing questions, I leaned on the brilliant insights of Rajeev Mantri, Founder and MD, Navam Capital. In a very candid conversation, he dismissed arguments that the NDA had lost its mojo. However, Rajeev didn’t mince words in stressing the urgency to roll out long pending reforms.

Sharing the link below:

Till we meet again next week, stay safe.

Thank You!

Finally, a big shoutout to Gautam for your informed response, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all readers. Gratitude to all those who responded on Twitter (X) and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I will be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

Inspite of nay sayers in the opposition and some other people who have a negative attitude towards the India growth story; our country is well and truly on the growth turnpike. The domestic consumption and indigenous generation of investment is indeed the trump card for India. This is further supported by the visionary government policy of supporting the BPL families with free ration support, ensuring their survival and contributing towards a comparatively low cost of labor. In the process India has become the favored investment destination for FDI to flow in at record levels. The government on it's part is investing in the required infrastructure to attract the FDI. The procurement of Defence equipment and the will to stand up to a regional bully, has helped to enhance India's image as a global power, which can maintain effective peace internally. Prudent decisions like employing Agniveers, in order to be cost effective have also enabled India to avoid external borrowing. The purchase of Russian crude oil and thriving is another success story. Definitely India is well on its way to becoming the third largest economy of the world. A very well articulated and interesting article Anil. Thank you for sharing.