A SERVICES EXPORT BOOM

India's export of services is seeing a sharp uptick, suggesting that the composition of the country's trade basket is undergoing a reset. EPISODE #116

Dear Reader,

A very Happy Monday to you

In all the gloom and doom about India’s flagging merchandise exports I stumbled upon a silver lining in the country’s trade story—export of services. I owe this insight to a remark by Sajjid Chinoy in an interview he granted last week for StratNews Global.

Over the last three years, there is a clear uptick in services exports from India. In fact, it is fast catching up with merchandise exports. So this week I explore this trend and the attendant implications.

The cover picture this week is a blast from the past. Sourced from Infosys, it features Nandan Nilekani and Narayana Murthy, co-founders of Infosys, a company, who along with a few others, stamped a global footprint for home grown tech capability.

Last week there were some typos in the newsletter. My apologies and a big thank you to Laxmi for flagging them.

A big shoutout to Laxmi, Ranjini, Premasundaran, Jehangir and Vandana for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by readers. Gratitude also to all those who responded on Twitter and Linkedin. Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊

EXPORTS RESET

It all started with Sajjid Chinoy, Chief Economist (India), J P Morgan. In an interview granted last week he flagged a new trend: India’s annual net trade (exports less imports) in services was discovering a new threshold of around $150 billion—almost double the previous average.

Flagging the growing share of services in India’s exports basket, Sajjid said:

“The fact that post pandemic digitalization has become more absorbed and prevalent in the world; and because work from home has made offshoring more acceptable has caused a huge surge in service exports.

Annually, net services used to be in the $80-85 billion range. That number jumped to $110 billion, and we weren't sure whether that would stay this year; but now it is tracking close to $150 billion.”

In fact, going by the current trajectory, India is poised to comfortably scale $300 billion in exports for the ongoing fiscal year, 2022-23. The final number could be around $320 billion. Given that merchandise exports is slowing, the gap with services exports is closing even faster.

In short India’s trade basket is poised for a reset.

The Tipping Point

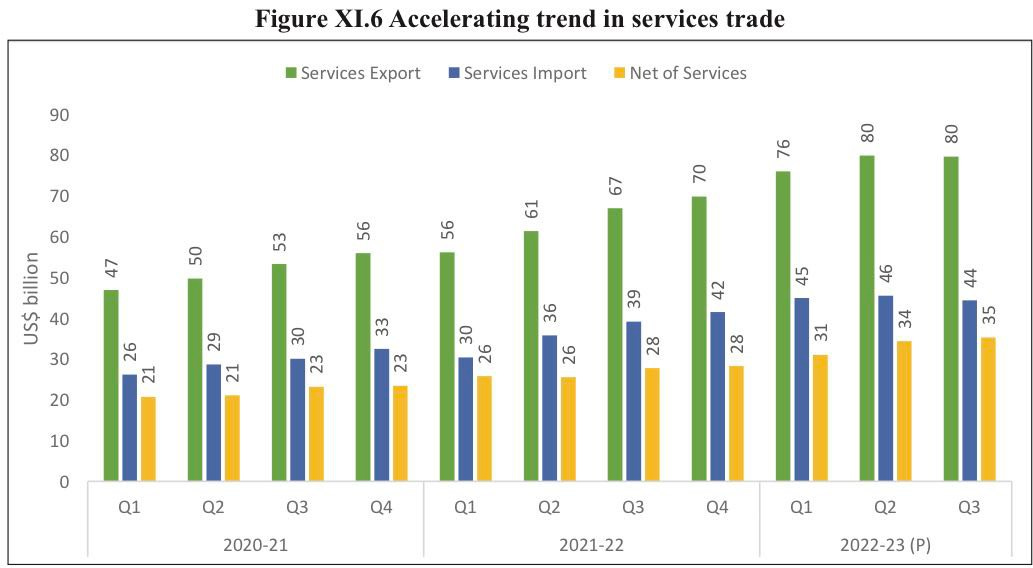

As the graphic above shows the upward trend in exports of services is very clear. At the end of January, services exports had cumulatively logged $272 billion. Given that the exports of services average around $30 billion each month, it is reasonable to expect that it would cross $300 billion for the first time this fiscal.

In fact, the gap between merchandise and services exports is closing rapidly. As a trade analyst put it:

“It appears that $30-billion a month mark may become a steady rate for services exports. Sooner than later, we may get a month where services exports will go past goods exports in terms of value.

These are staggering numbers for a low middle income economy, and will put India in top five services exports countries very soon.”

Coincidentally, a few days after my conversation with Sajjid, the newsletter circulated by Pranjul Bhandari, Chief Economist (India), HSBC, made a detailed presentation on this very trend.

Her conclusions were similar:

“On a net basis, services exports are now raking in USD60bn/year more in revenues than in the pre-pandemic period.”

And then added:

“Beyond the next two years, the outlook for services exports looks exciting as tech penetration spreads.

NASSCOM has a target of USD500bn in IT services revenues by FY30. If this target comes to bear, net services exports could rise further, leading to an increase in net services exports by USD100bn between FY23 and FY30.

This is important because as India’s GDP growth rises, as do goods imports, a higher services surplus could help fund a rising goods deficit.”

The New Normal

It is clear from the graphic above, sourced from this year’s Economic Survey, that the sharp growth in India’s services exports is not one-off—it has been growing in every quarter. And there is every chance of this trend enduring.

Traditionally exports of services from India accrues through four broad modes:

Cross-border;

Foreign consumption (tourism, education, healthcare);

Representative commercial presence abroad (an architect opening a small office in the sales destination, but delivering the work via mix of local and cross-border presence);

Temporary movement of natural persons (India’s outsourcing IT model).

Previously India’s competitive edge was discovered through the IT outsourcing model—pioneered by the likes of Infosys. Hence the country has always sought to push its trade partners to allow easier and larger movement of personnel (like through enhanced quotas for H1 B visas).

The big news underlying this new trend in export of services is the rise in cross border transactions. While export of IT services continues to be the dominant share, there is a visible increase through other modes.

And the trigger for this, as Sajjid flagged, was the pandemic—which created the #WFH opportunity. For multinationals, #WFH principles meant that it was much cheaper to house this in low cost centres like India.

The Economic Survey for 2022-23—the annual economic report card presented ahead of the Union Budget by the Ministry of Finance—commented on this trend:

“While strong revenues in major information technology (IT) companies from various segments such as retail and consumer business; communications and media; healthcare; and banking, financial and insurance services drove the growth in software exports, a significant pick-up in engineering, and research and development related services boosted the growth in business services exports during the quarter.”

The trend in the commoditisation of services, especially with the rise of cloud, has only hastened this process. Especially since it is blurring the distinction between service and merchandise exports.

For instance, an Indian firm providing security services may supply hardware and surveillance/responder services. The latter can be undertaken remotely, say out of India, but may form part of a single contract that includes supply of equipment and services.

One such instance is the rise Global Capability Centres (GCCs)—delivery centres created by MNCs. According to Pranjul, these GCCs provide tech, engineering and IT support, as well as R&D.

“India is home to about 40% of global GCCs, and this ratio is only expanding as GCCs rise in scope. Starting off as providers of support functions, they have moved up the ladder, to R&D and business development.”

The GCCs are rapidly emerging as a key part of the global supply chain. The ‘China plus-one” together with “friendshoring” (where economic engagement is defined by shared values) will only accelerate this trend. Simultaneously, the growing adoption of digital means of payment, is facilitating friction-less payments—greasing the wheels of commerce as it were.

Alongside the second mode—foreign consumption of Indian services—too is witnessing a revival. Prior to the onset of the covid-19 pandemic, this was a rapidly growing segment.

For instance tourism arrivals in 2019 crossed 10 million, only to be disrupted by the pandemic. Revival in sentiment together with marked improvement in infrastructure—especially highways and train travel (Vande Bharat)—and connectivity is triggering a rebound. Similarly, the ‘Heal in India’ campaign is beginning to boost medical tourism in the country.

In the final analysis it is clear that India’s services exports has crossed a tipping point. The ongoing domestic makeover will only improve India’s competitive advantage. Similarly the geopolitical reset is giving the country a strategic edge.

It is only natural to conclude that India’s trade basket is acquiring a new and welcome hue.

Recommended Viewing

Sharing my latest post on StratNewsGlobal.

This time my guest was the brilliant Sajjid Chinoy, chief economist (India) for J P Morgan and also a part-time member of the Prime Minister’s Economic Advisory Council (PMEAC).

Our conversation sprang from the debate over the latest numbers on India’s gross domestic product put out by the Central Statistics Office (CSO). While newspaper headlines claimed a slowdown in growth, government officials and experts argued otherwise—since the growth for the previous years was revised upwards, they argued that this was tantamount to comparing apples and oranges.

In an unmissable conversation, Sajjid laid out the opportunities and challenges ahead of India. Do watch. Sharing the link below:

Till we meet again next week, stay safe.

Good article as always Anil. A bit hyped up, but I can forgive you for that:) The share of Services exports in overall exports has improved by about 5%. From 37% in the previous year to 42% currently. https://commerce.gov.in/wp-content/uploads/2023/02/Press-Release-January-2023.pdf

For me, as a former DG of the Services Export Promotion Council, the issues are two-fold:

a. Our services exports continue to be heavily software services based. Since they keep growing, the general feeling is that we don't need to worry much about Services. RBI data shows that of the total receipts on account of services, 50% are from software alone. The RBI releases some data, but nothing is available market-wise.

b. In the bargain, other sectors such a legal, IP related, environmental services, AVGC, get ignored. We have to get out of the software complacency, and look closely and positively at our Services exports. Incentives such as SEIS should be restored on carefully assessed sectors while ensuring that there is no misuse. A services based PLI perhaps?

On another note, people like Richard Baldwin, faculty where I am currently studying, are extremely upbeat about India's services sector. He quotes India as a services export miracle, and that too without any FTA.

Congratulations for bringing out another excellent article. The conversation with Sajjid Chinoy was a much needed one which truly helped to put things in perspective especially when the waters had been badly muddied by erstwhile economists! Glad that you explored in detail this particular facet which had been highlighted by Sajjid Chinoy.

Regarding service exports, I wonder if anyone has done any proper study of a rapidly growing area - tuitions/individual academic coaching. With a large, young NRI population in Western countries, many of them are unhappy with the quality of academic coaching provided by the schools in these countries and are engaging online tutors for their children. The rapid growth in internet and cheap data is enabling tutors even in remote locations to coach children anywhere in the world. Agencies are mushrooming all over the place aggregating teachers and acting as service providers.

One question I would like to be answered is whether there is any substance in Raghuram Rajan's argument about looking more towards services than manufacturing for both growth and employment. From what I see around me, the service sector seems to be absorbing people with a higher level of skill set and education and that even now would form only the smaller sub set of the working population. Even if we cannot repeat a China and become the manufacturing capital of the world, with a 1.4 billion market of our own, can we not create enough manufacturing jobs to make a meaningful shift from farm labour?

Looking forward to further newsletters. Thank you for your wonderful work.