India's IPO-Fuelled Risk Revolution

The latest IPO boom put the spotlight on India's growing risk appetite and its fundamental pivot from a saver to an investor nation. EPISODE #233

Dear Reader,

A very happy Monday to you.

Trumpian economics and fluid geopolitics notwithstanding, Indian companies are poised to raise over $2 billion from Initial Public Offerings (IPOs) in July alone. In fact, the country’s share in global IPO listings has risen from 17% in 2023 to 30% in 2024—the highest in the world.

A subtext of this phenomenon is the contribution of the Indian retail investor. For long they were considered risk averse, preferring safety over returns. No longer. Their growing risk appetite is the underlying story of this IPO boom. This week I put the spotlight on India’s makeover from a saver to an investor nation.

The cover picture is another view of the magnificent spread of the Banyan tree located in the village of Barpar. It is the office complex of the first-time MP from Deoria, Shashank Mani. The view is a perfect metaphor capturing the growth and spread of retail investor sentiment in India.

Happy reading.

Investor Nation

Never before has the world witnessed so much of uncertainty.

First, every year since 2020, the world has suffered a global shock. It began with the once in a century covid-19 pandemic that had dodgy origins in Wuhan, China. Second, the acrimonious face-off for global supremacy between the United States and China has acquired unprecedented momentum, disrupting global supply chains developed over four decades. Third, the return of President Donald Trump has thrown a spanner in the works of global trade. Finally, from India’s point of view, it was engaged in a short war with Pakistan (and, China providing tactical support).

Amazingly, the Indian stock market seem to have shrugged off all these setbacks and resumed its merry way. The uptick in the market for Initial Public Offerings (IPOs) is striking.

A very important subtext of this story is the contribution of the Indian retail investor in inspiring this revival. For a host of reasons, the Indian retail investor has acquired a voracious risk appetite and remarkable resilience to ride out the ups and downs of the stock markets.

This is not a story about the stock markets. Instead, it is about the makeover in the money-mindset of a nation.

Mindset Reset

The above graphic, sourced from the latest Economic Survey, shows how this surge in retail investors is very recent. And, very dramatic at that: Growing nearly three-fold to 13.2 crore in a span of five years. Further, these investors are expanding their presence in both the primary (IPOs) and the secondary market for stocks, providing an unprecedented boost and investor base to financial markets.

As stock valuations improve it allows more promoters to approach the markets to raise funds by hiving off equity. In turn, this reinforces the investment cycle, which then gradually deepens and widens financial markets to provide the fiscal muscle promoters need to fund their ventures. And, eventually this plays into the growth cycle.

Sanjay Bakshi, the academic with rockstar credentials and value investor, dropped this truth bomb in a recent interview for StratNewsGlobal.Tech on how India’s home grown defence companies manufacturing world-class combat equipment are going public.

It was a perfect summing up of the investment cycle, which is now willing to fund even risky bets like defence:

“So what is the role of financial markets?

If you look at the valuations, you mentioned the Nifty-Defence Index; so the valuations are very high. But what does that imply for us? When valuations go up a lot, it creates incentives for entrepreneurs to go public.

There are companies which are already in the defence space. There are a whole bunch of companies that are in the unlisted space that want to go public, and they will see a lot of interest in going public.

So I think that's going to be wonderful for for those entrepreneurs.”

The Smart Investor

Undoubtedly, a key factor driving this stock market boom is the Indian retail investor. They are channelising their savings through different routes into financial markets. All of this only highlight the changing mindset of the Indian retail investor—willing to absorb greater risks.

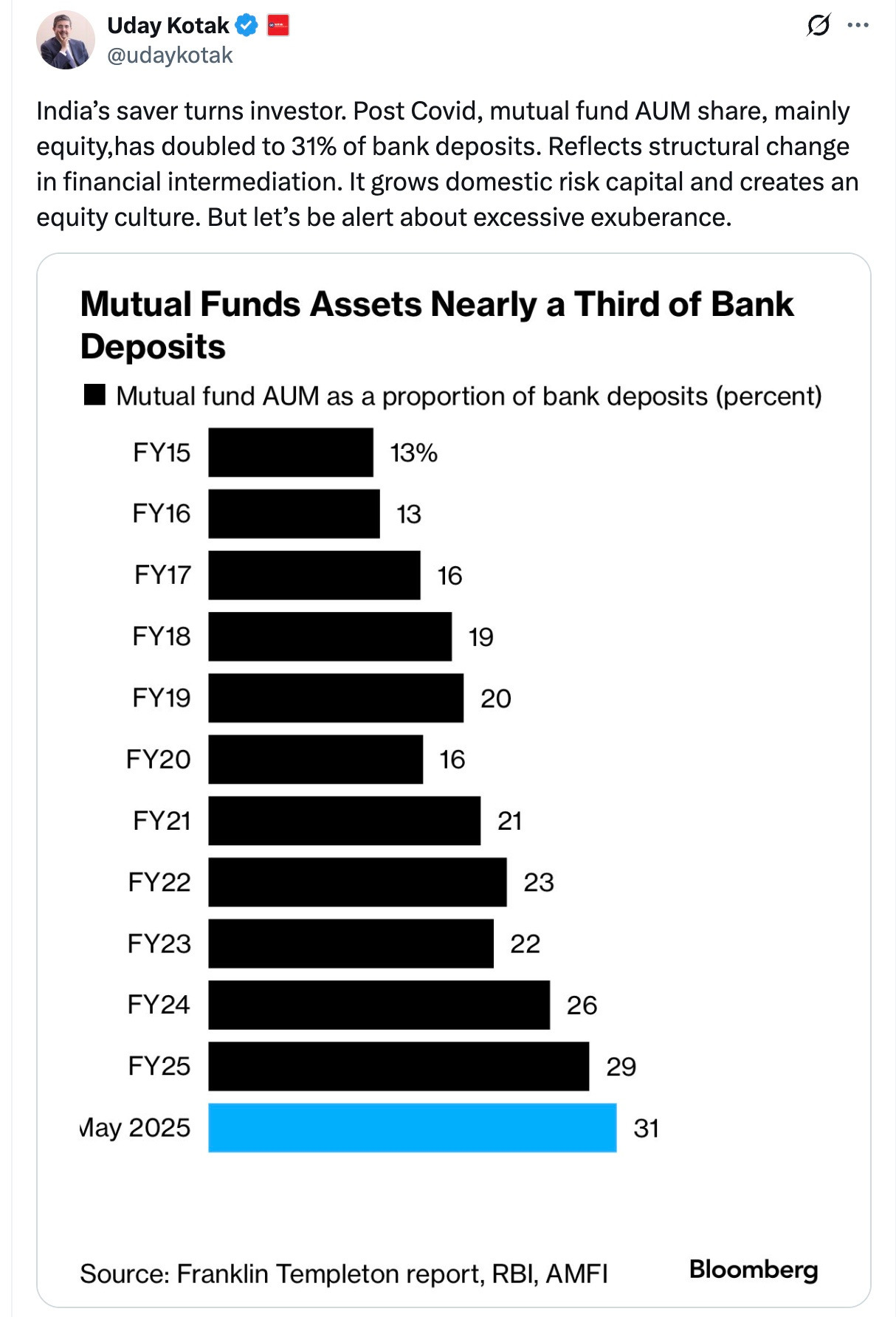

Uday Kotak, founder of Kotak Mahindra Bank, and an astute observer of trends argued that the Indian saver was turning into an investor—moving their funds out of bank deposits into mutual funds. Check out the screen grab above of his post on X.

There was a time, especially for people of my vintage, when the only investment option was either risky deposits with companies or safer routes like bank and postal deposits. Further, the idea of living in debt was shunned—drilled into our psyches by concerned parents.

No longer. The mantra now is to live beyond your means—an individual is confident of growing his/her investments and income in a rapidly improving Indian economy and retire the debts. The latest Financial Stability Report (FSR) from the Reserve Bank of India (RBI), shows that household debt-to-GDP has grown to nearly 40%. India’s demography—wherein 65% are less than 35 years of age—no doubt contributes to the investor being less risk averse.

The thing is that this pivot is not happening in a vacuum. The Indian economy is now the fourth largest economy in the world. Further, a targeted approach to welfare spending and saturation access to basics like electricity, banking, cooking gas and so on, has managed to shrink abject poverty to single digits. All of this, unlike in the past, has spread the benefits of growth.

The World Bank released a study last week which confirms this claim. Using the measure of the Gini Index, it revealed that India was the fourth most equal country in the world, after the Slovak Republic, Slovenia and Belarus.

Check out the graphic below:

Wealth Effect

The economy of New India is triggering a wealth effect—wherein expanding household and individual incomes is giving rise to a boost in consumer spending and aspirations. This too encourages a risk appetite.

Last year, I had examined the trends in Income Tax Returns and captured this wealth effect—check out the graphic above.

I am also sharing a link to the newsletter. In case you wish to re-read it:

It is then safe to claim that like everything else about New India, even the mindset of the retail investor is undergoing a makeover. The remarkable increase in risk appetite augurs well. Not just for stock markets, but in growing the country’s entrepreneurial base.

Recommended Viewing

Sharing the latest episode of Capital Calculus. (Please note that Capital Calculus has moved to a new home (stratnewsglobal.tech) within StratNews Global. This relocation will take a bit of getting used to.)

It took 77 years for a state-transport bus to enter Katejhari, a tribal village in Maharashtra’s Gadchiroli district. This was because for seven decades, Naxal or Red Terror had denied this village the benefits of state-sponsored development. At its peak, the writ of Naxals stretched across the states of Jharkhand, Chhattisgarh, Maharashtra, Odisha and Andhra Pradesh.

No longer. In fact, the union government has announced that by next March, India would be free of Naxal terror. The obvious question: Will this long neglected region witness a mainstreaming of development? Can the government earn the trust of the locals and make them stakeholders in growth?

To answer this and more, I spoke to Sunil Kumar, former chief secretary of Chhattisgarh—one of the states that was at one time in the grips of Naxal terror. Coincidentally, his first posting was in Bastar, at one time the ground-zero for red terror.

In this unmissable conversation, the former chief secretary was optimistic about the region’s prospects. But, he stressed caution and a soft touch to manage historical wounds and tap into the aspirations of the locals.

Do watch. Sharing the link below.

Till we meet again next week, stay safe.

Thank You!

Finally, a big shoutout to Gautam, Premasundaran and everyone else for their informed response, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all readers. Gratitude to all those who responded on Twitter (X) and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I will be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

A very interesting article Anil and with very pleasantly surprising figures. One feels that the increasing numbers of retail investors are the younger generation, who are influenced by friends, colleagues and advertisements, where the government is also playing a big role. Even the traditional accumulation of gold has added significantly to the wealth in individual families, due to the phenomenal rise in the price of the yellow metal. Increased liquidity in the hands of a vast number of Indians, has resulted in this rapid growth of the share market and other areas of investment that promise better returns. The safe havens of risk free and assured income are now catering to retired and generally older Indian citizens. Disruptions to this unprecedented growth, has been attempted but the markets and investors have reacted with greater show of investors confidence. Thank you Anil for sharing this very informative and important article. 👍