Green Conflict Minerals

The world's green ambitions are hostage to the challenge of mining in dangerous locations and China's dominance in processing. EPISODE #153

Dear Reader,

A very Happy Monday to you.

Last week the the United Nations Environment Programme (UNEP), the multilateral body which sets the global environmental agenda, released its Emissions Gap Report, 2023. The big headline is that this will be the hottest year ever and the world is way off the mark in fighting climate change.

There is a more important subtext to this warning.

It is about the path to greening the world. It is based on the ability to mine minerals like nickel, lithium and so on, all of which are located mostly in countries with unstable political regimes and riven by corruption. Worse, processing capacity of such minerals is concentrated in a few countries like China.

This week I explore the idea of ‘Green Conflict Minerals’ and how it can hold the world’s green ambitions hostage. Do read and share your feedback.

The cover picture is sourced from Pixabay.

A big shoutout to Surendra, Aashish, Gautam, Premasundaran, Vandana and Ranjini for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all you readers. Gratitude also to all those who responded on Twitter and Linkedin.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I would be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

Green Minerals

Last week the the United Nations Environment Programme (UNEP), the multilateral body which sets the global environmental agenda, released its Emissions Gap Report, 2023.

The big headline is that this will be the hottest year ever and that the world is at risk of breaching the ceiling of 1.5 degrees Celsius above pre-industrial levels. The UNEP report disclosed that for 86 days in the 10 months ended October 2023 temperatures topped this ceiling.

In fact, the report argues that unless countries commit and deliver deeper cuts in greenhouse gas (GHG) emissions for this decade, global average temperatures are on track to rise by 2.5-2.9°C above pre-industrial levels.

There are worse tidings.

A month earlier, the United Nations released its Interconnected Disaster Risks report 2023, which argued that threats from rising temperatures was getting amplified as they were playing off other crises like groundwater depletion and mountain glaciers melting.

These impacts are cascading and have brought the world close to the tipping point from where it will be near impossible to pull back. In short, the world is on the road to environment perdition.

Check out the video shared below.

While this is disconcerting, there is a more worrying subtext to the world’s plans to embark on a sustainable path. Even if a deeply divided world was to beat the odds and generate consensus on a net-zero strategy that will save the world, there is another challenge. And, resolving this is equally tricky.

The path to net zero requires a transition to renewable energy and this in turn requires access to critical minerals, metals and rare earth elements. The problem is that most of these green minerals are located are in countries with unstable regimes and prone to rampant corruption. Consequently, the supply chain for these conflict green minerals is inherently unstable.

Worse, over the last two decades China has inserted itself as an intermediary, leaving it in a position to weaponise access and hold the world’s green ambitions hostage.

Given the adverse turn in geopolitics, especially the decoupling between the United States and China, this outcome is highly likely—as we witnessed in the recent face off between the United States and China over silicon chips.

The oil price shock of 50 years ago—and the existing elevated price levels for oil and food grains—is another reminder of how supply chains can be weaponised.

Equally worrying is that this grave risk to the supply chain for critical green minerals has not got the desired attention in global conversations to save the planet.

A Wake-up Call

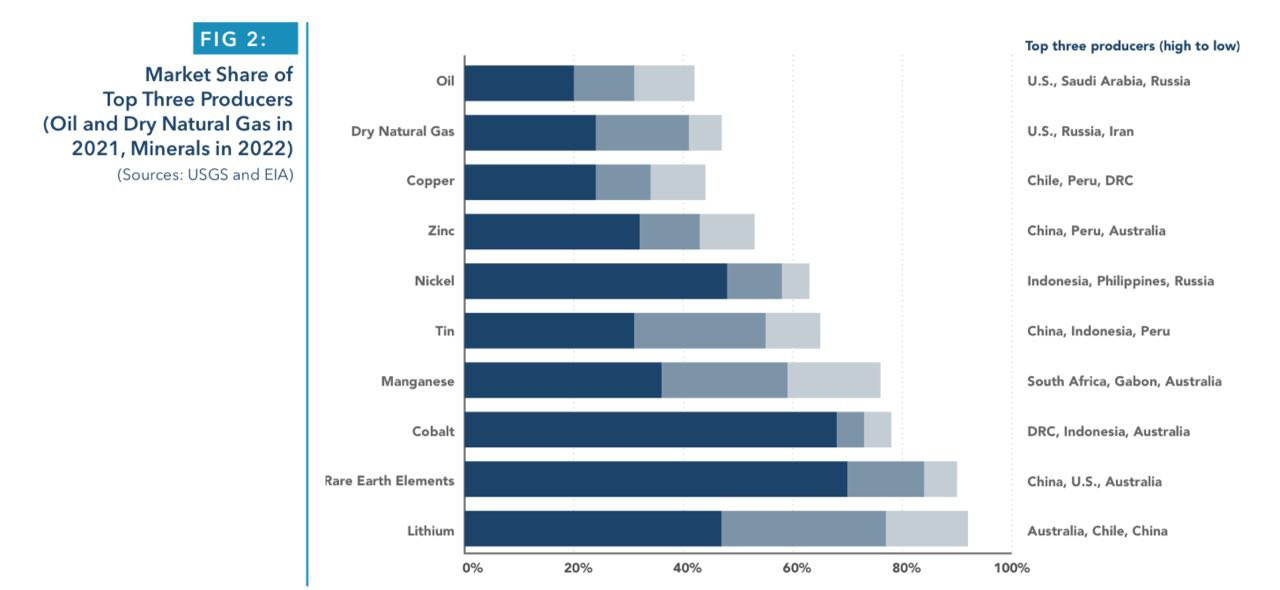

If the stranglehold of a few producers on global oil production is a cause for worry, then checkout the situation for production of critical minerals—needed to facilitate a green transition of the global economy.

Data (see graphic above) sourced from a recent study submitted to the US Congress reveals that top three producers of critical green minerals control over 50% of global production. In some instances, like lithium, rare earth elements, cobalt and manganese the share is more than three quarters of global production.

And if we drill down further, we find the dominance of China in the processing of critical minerals.

Check out the graphic below, sourced from the same report:

China, also exercises indirect control of production of critical minerals in other countries.

Riding on the wave of globalisation over the last two decades, China made steady global acquisitions of overseas mining assets. For example, 15 of the 19 largest cobalt producing mines in the Democratic Republic of Congo were either fully or partially financed by Chinese companies.

This geographic dominance is unlikely to be reversed in the next decade. The International Energy Agency (IEA) shared projections in its World Energy Outlook (WEO) 2023, released a few weeks ago.

Check out the graphic below:

Cooperate or Perish

There is a clear message from the state of play for critical green minerals. While in the long term this geographic dominance can be partially reversed, there is no such option in the short term.

And, given that the climate change clock is ticking, the world’s high table needs to get their act together and literally COP one for the world. This means burying hostilities for a larger cause. This may sound impossible given the binary circumstances dominating global polity. But, let us not forget that the world came together, briefly albeit, to fend off the once in century covid-19 pandemic.

The upcoming COP or Conference of Parties meet in Dubai is a perfect platform to signal a rethink for global good.

Fingers crossed.

Recommended Viewing/Reading

Sharing the latest post of Capital Calculus on StratNews Global.

In less than a fortnight from now, the world’s high table, the Conference of Parties (COP), for battling climate change will converge in the United Arab Emirates. Readying for this I have been doing a series of interviews which also serve as walk-ups.

Last week I interviewed Siddharth Singh, Energy Investment Analyst in the office of the Chief Energy Economist, International Energy Agency (IEA), and co-author of the World Energy Outlook (WEO) 2023—released a few weeks ago.

It made for a fascinating read. For one, it argues that fossil fuel consumption is about to peak. Second, a slowing Chinese economy will decrease global emissions. Third, there is an urgent need to underwrite green transitions in the resource strapped global South—the next big source of energy demand as their economies play catch up with developed majors.

How does all this stack up? The insightful conversation with Siddharth helped unpack these trends and make sense of the present circumstances.

Sharing the link below. Do watch and share your thoughts.

On another note, Prime Minister Narendra Modi gave the biggest endorsement to Tejas, India’s home grown Light Combat Aircraft (LCA), when he undertook a sortie in it on Saturday.

Needless to say it is remarkable for a 73-year old man to negotiate the pull of gravity in a supersonic jet.

A happy coincidence that I wrote about Tejas last week.

In case you missed reading it, sharing last week’s newsletter on Tejas at the just concluded Dubai Airshow.

Tejas: Flight of Ambition

Dear Reader, A very Happy Monday to you. Last week I attended the biennial airshow in Dubai—the watering hole for all things aviation, including defence. Rubbing shoulders with the world’s best was India’s home grown Tejas and the range of powerful BrahMos missiles.

Till we meet again next week, stay safe.

Some critical information Anil, unsettling but important for securing future growth. The attached video, adds another dimension to the complex catch 22 situation. Personally, I feel that India should be concentrating on the problem of recharging ground water levels, as explained in the video, as it will affect the livelihoods of farmers and the economy. It has been now concluded that ground water levels affect warming and environmental degradation leading to air and water pollution. The greed to earn well by exporting Basmati rice is also leading to depletion of ground water in Punjab and Haryana, which have an annual rainfall, that is more suitable for growing wheat and pulses. The problem of single use plastic choking the soil and water, in most of the world, should also be given top priority, alongside investing in rain water harvesting. Let China and other big powers fight for control of "green minerals" that will lead to dominance in alternative energy sources. India will will be able to manage and discover its own sources of the coveted "green minerals" in due course. Reports of acid rain in China, where rare earth minerals were mined are there and the plight of unemployed graduates in China are doing the rounds. Any growth is good if it is people friendly. Look forward to your enlightening updates.

Thanks Anil for raising this important issue. You have covered everything to be analysed on this issue. To resolve the stranglehold of China, we need either alternative technologies like the one based on sodium and hydrogen based power or we may even witness geopolitical shifts wherein Chinese would be ousted from Africa and South America. USA will not hesitate to use its old tricks of the trade to change the regimes anywhere!! And why not, if it is in the larger interest of the world at large!!! But next few years are challenging. Of course, if India finds its own minerals either on land or under sea, then it may be a different scenario for us. Like recent find of Lithium in Kashmir. We must reactivate our Rare Earths Ltd PSU which was rarely working until now!!!