Banking Bharat

India has bridged the gender gap to bank over 500 million people in the last 9 years, enabling potential access to the benefits of a formal economy. EPISODE #141

Dear Reader,

A very Happy Monday to you.

Last week India celebrated the ninth anniversary of the Pradhan Mantri Jan-Dhan Yojana (PMJY)—the no-frills bank account. In this period India has successfully banked 500 million people—of this more than one in two are women.

Put it another way, more than a third of India was unbanked in 2014.

Imagine your bank account and related financial infrastructure being abruptly withdrawn. Our world will come crashing around us. Finance greases the economic wheel. At the same time, you will also realise the empowerment a bank account unleashes on those who are banked for the first time.

This week I explore one of India’s most remarkable successes.

A big shoutout to Gautam, Mary, Ranjini, Premasundaran, Aashish and Vandana for your informed responses, kind appreciation and amplification of last week’s column. Once again, grateful for the conversation initiated by all you readers. Gratitude also to all those who responded on Twitter and Linkedin.

The cover picture is sourced from the World Bank’s photo archives. Thank you.

Unfortunately, Twitter has disabled amplification of Substack links—perils of social media monopolies operating in a walled garden framework. I would be grateful therefore if you could spread the word. Nothing to beat the word of mouth.

Reader participation and amplification is key to growing this newsletter community. And, many thanks to readers who hit the like button😊.

Taking Banking to Bharat

Last week the country celebrated the ninth anniversary of the Pradhan Mantri Jan-Dhan Yojana (PMJY). It was indeed a moment of celebration.

Sadly however, it largely went unnoticed.

A shame, because in these nine years India managed to bank 50.09 crore or 509 million people—this is more than the population of the United States. Another staggering achievement, India lifting 415 million people out of poverty in the 16 years ended 2022, met with a similar muted response.

Regardless, what India has achieved is most impressive—increasing the proportion of adults holding a bank account from 30% in 2014 to 80% at present.

According to a research paper published by the Bank for International Settlements (BIS), the bank of Central Banks headquartered in Basel, Switzerland, this kind of financial inclusion will normally take a country 47 years to achieve. And, this in turn would require per capita income to grow from $5,000 to $20,000.

And India did this in nine years; its per capita income in this period has grown from around $1,500 to $2,500.

A better story still is how the country managed to pull this off.

The Record

Broadly, the staggering gains from the PMJY as on August this year are as follows:

50.09 crore Jan Dhan accounts opened (as of August 9, 2023);

55.6% (27.82 crore) Jan-Dhan account holders are women;

66.7% (33.45 crore) of Jan Dhan accounts are in rural and semi-urban areas.

The graphic above, sourced from the BIS paper I referred to earlier, lays out their dramatic claim—India shrank the timeline for achieving this scale of financial inclusion—about PMJY.

It then goes on to argue that the programme also managed to reduce the exclusion of marginalised groups—including women.

“The increase in financial inclusion was also accompanied by a sharp reduction in the exclusion of marginalised groups more generally.

The gender gap—the difference between the shares of men and women with a bank account—diminished from 17% in 2011 to 6% in 2017.

Similarly, the inclusion difference between those in and out of the labour force fell from 18% to 9%; between those with secondary education and those without from 29% to 10%; and between rich and poor from 14% to 5%.

The gaps are now all less than world levels.”

India is no longer the most unbanked country in the world.

Democratising Identity

The graphic above captures the progress of India’s audacious plan to bank half a billion or 50 crore people.

A key enabler in this was Aadhaar—the 12-digit unique identity project that was launched in 2009 under the leadership of Nandan Nilekani, the present chairman of Infosys.

Aadhaar, India’s first digital public good, solved for the challenge of identity—till it happened, people were denied even basic benefits as they struggled to prove their identity. By using biometrics it provided a trustworthy identity, including for those who cannot read and write—as per Census 2011, nearly a quarter of India was illiterate.

The use of Aadhaar enabled eKYC (Know Your Customer electronically), effecting another round of disintermediation and accelerating the project to bank the unbanked.

As a result, by the time the covid-19 pandemic, which had dodgy origins in Wuhan, China, struck in 2020, India had successfully banked nearly 40 crore people.

More importantly it had pioneered a unique idea by tagging an individual’s Jan Dhan bank account, Aadhaar and mobile number.

The resulting acronym was JAM, which for want of better can be best understood as an ‘economic GPS’—it helped the government identify the beneficiary of a social welfare programme. Not only did this target the benefits, but it also prevented leakages in social welfare programmes.

Using JAM

As mentioned earlier, by the time Covid-19 struck, India had a faceless public delivery system—based on JAM—in place. Since social contact was frowned upon for most of the first two years of the pandemic, delivering public good would have been a challenge without JAM.

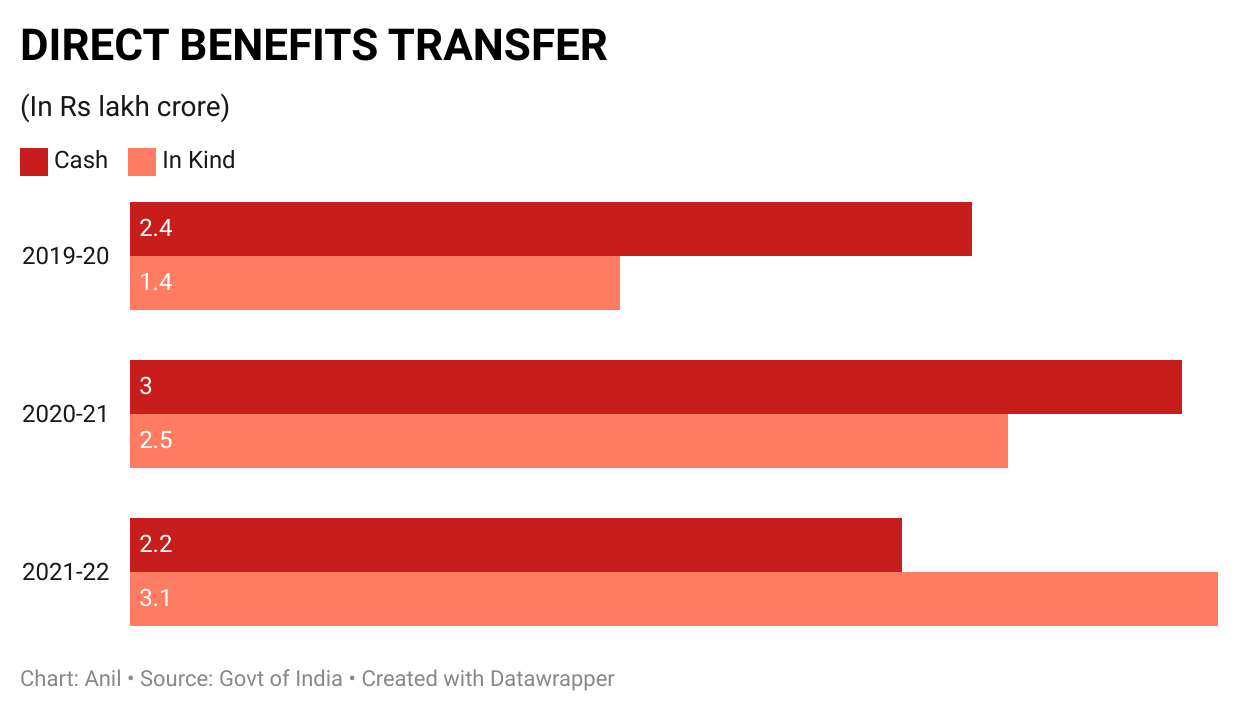

As the graphic above shows, JAM enabled massive covid-relief as cash transfers from the government in the first two years of the pandemic.

These DBTs or direct benefits transfers rose from Rs2.4 lakh crore to Rs3 lakh crore in 2020-21. It is one of the reasons that India fared better, in a relative sense, compared to other countries in providing relief.

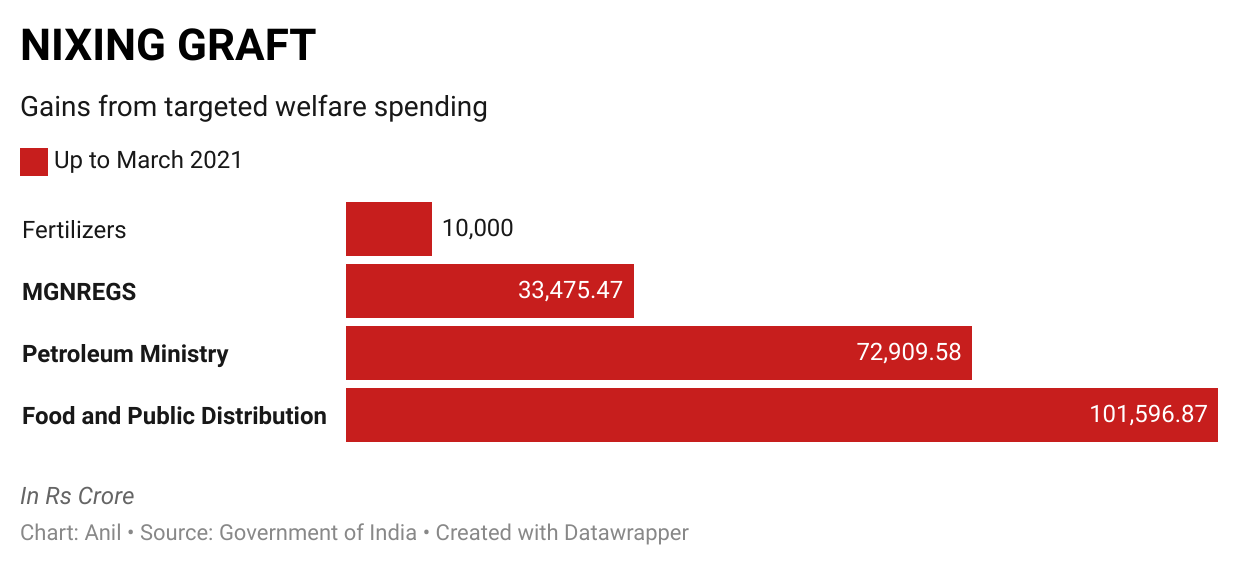

A collateral gain from all of this is massive savings to the exchequer.

Cumulatively so far DBT has saved the exchequer about Rs3 lakh crore—that is twice the size of the first covid-19 relief package and thrice the annual budget for the rural employment guarantee programme.

In the graphic below, I have broken up the gains accruing to the exchequer at the end of March 2021.

Road Ahead

It is then clear that India has managed to bring previously excluded groups, particularly the poor and women, into the formal banking system.

Now, 50.09 crore people are inside the system looking out. In other words, they are stakeholders in India’s growth process.

As financial innovation accelerates and this newly empowered cohort begins to avail of the benefits of the formal system—particularly access to credit—they will become even more deeply invested in the Indian economy.

All of this makes the country’s growth process more inclusive and sustainable. Not to speak of the expansion of the size of the consumer market—the power of mainstreaming Bharat.

Recommended Viewing/Reading

Sharing the latest post of Capital Calculus on StratNews Global.

You may recall that a few weeks ago I explored the latest filings of Income Tax Returns or ITRs by salaried taxpayers and other non-tax audit cases for 2022-23. It showed that ITRs had grown to a record high of 7.4 crore.

True, but a deeper dive revealed the wealth effect: Across income tax slabs, ITRs grew dramatically in the 10 years ended 2022-23. It either doubled, trebled, or in some instances even quadrupled.

It confirms the unprecedented trading up in the Indian economy as households are visibly becoming richer—in a relative sense—as the value of their assets grow. It therefore begged the question: Are Indians are getting richer?

To answer this and more we spoke to Feroze Azeez, Deputy CEO, Anand Rathi Wealth Limited.

Not only did Feroze confirm the initial hypothesis but he also pointed out very interesting trends, including how the wealth effect is spreading beyond metros. Sharing the link below.

Do watch and share your thoughts.

Till we meet again next week, stay safe.

Dear Anil,

Informative and interesting article! Agree with you that Jan Dhan Yojna has led to the financial inclusion revolution. The JAM trinity ( jan dhan- aadhar - mobile) has made public service delivery more efficient and transparent.

However, despite the visible progress, the growth in account activity such as ATM transactions ,short term credit, insurance, overdraft facility etc is slow . RUPAY cards were given to each account holder but according to govt data at least one in five card is dormant.Also , nearly 20% of these accounts have zero balance. We all remember these Jan dhan accounts saw , unusual cash deposits during demonetisation in 2016.

Dear Anil

It's truly impressive that you highlight issues which one normally takes for granted- be it electricity, drinking water or bank accounts. We have always known about bank accounts even before we knew how to operate them. It's really a great achievement in such a short span. It's a pity that it's ninth anniversary went unnoticed. Having said that, it's equally commendable that you are able to keep track of such anniversaries and achievements considering that no one else does!

It's really heartening that more than half the account holders are women. Whether a lady is an earning member or not, the onus of running a household eventually falls on her. It may not be apparent but it's surely a balancing act between earnings and expenditure. Gone are the days when women had to hide money in provision boxes or tucked away in a corner of the cupboard. Her savings for a rainy day. Now she can save money in her own account. Not only will that generate more money and more importantly no one else can misuse it without her knowledge.

The acronym JAM actually explains in a nutshell the reason for the amazing success of this ambitious scheme. The point to be noted is there have been massive savings to the exchequer despite providing so many benefits. Money saved is money earned. All in all, a win win situation.